Lamb producers will head into 2023 with confidence as a rebuilt flock and wet conditions fuel a period of high production with prices to remain high from a longer-term perspective

A high supply environment is set to continue for Australian lamb into the first half of 2023.

A rebuilt national sheep flock led to increased lamb numbers in 2022, of which a larger than expected number will carry over into 2023 due to disruptions getting marketed in late-2022.

In addition to an increased volume of lambs to be processed in early 2023, wet conditions and delayed selling will mean lambs will have grown to heavier weights, resulting in a 5 to 10% increase in lamb production compared to a year earlier.

While supply will be higher year-on-year, it is expected to be lower than the surge of lambs seen in late-2022.

Producers will likely remain encouraged to expand flocks, however the pace of flock growth will slow compared to the last two years.

Increased Australian lamb supply will encounter marginally weaker competition from New Zealand in export markets.

New Zealand lamb exports are forecast to decline by less than 1% in 2023 off the back of reduced breeding ewe numbers coupled with dry conditions in some regions in 2022.

This adds to a larger reduction in New Zealand lamb export volumes during 2022.

Demand is an issue

Demand for lamb will likely soften in both domestic and export markets as economic conditions take their toll on consumer spending.

The relatively higher price point of lamb and a greater proportion of consumption through foodservice outlets makes it more susceptible to consumers managing cost of living expenses by substituting for cheaper alternatives and not dining out as frequently.

This trend is evident in the slow decline of average export prices in the second half of 2022 and will likely persist into the new year.

Despite weakening consumer sentiment, Australian exports should be able to capitalise on growing momentum in an increasingly diverse range of markets and a broad demand base.

While the US is showing greater signs of softening demand due to inflation, the longer-term growth trend to the US remains strong.

Bright spots in 2023 could be further growth to South Korea which has risen to be the third most valuable market for lamb due to a doubling in export value across the last two years.

Improved access to India and the UK could also mitigate softer demand in existing key markets as free trade agreements come into effect and open new opportunities.

A crucial factor to watch will be the ongoing impacts of China’s COVID zero policy.

Of Australia’s top 10 lamb markets, China was the only one to decline in value in 2022 as lockdowns and restrictions on foodservice hampered demand.

Price is running hot

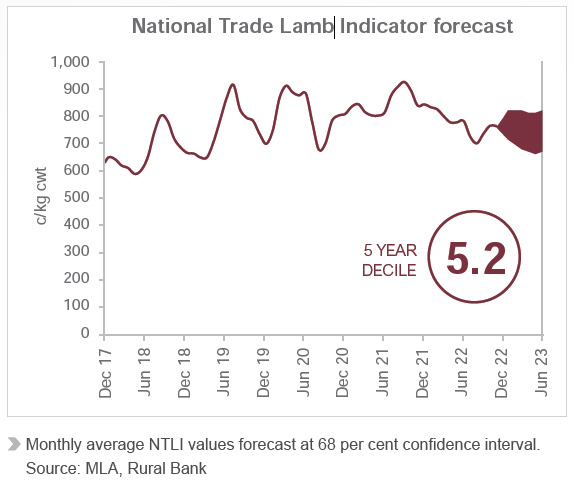

Australian lamb prices are expected to improve in early 2023 as the surge of supply carrying over from late-2022 tapers off.

However, prices will be lower year-on-year and likely trend at or below five-year average levels under the weight of elevated supply.

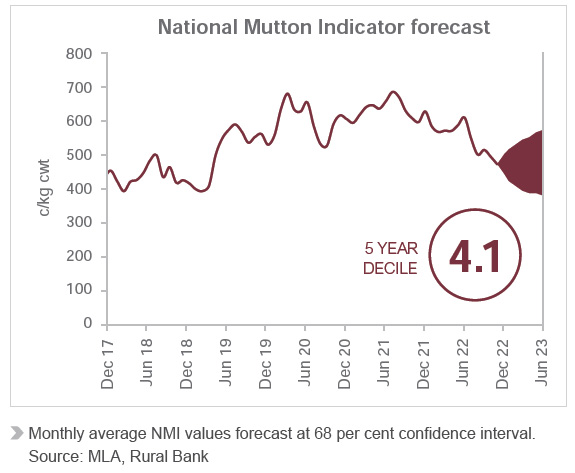

This should combine to see the National Trade Lamb Indicator operate between 740-790c/kg. Mutton prices will likewise be weaker under the weight of increased supply and relatively softer demand. This will likely see the National Mutton Indicator remain below 500c/kg.