Net sales of US$2.1 billion for the Q1 2025 represent a 30% decrease from last year and a trend the company would like to reverse

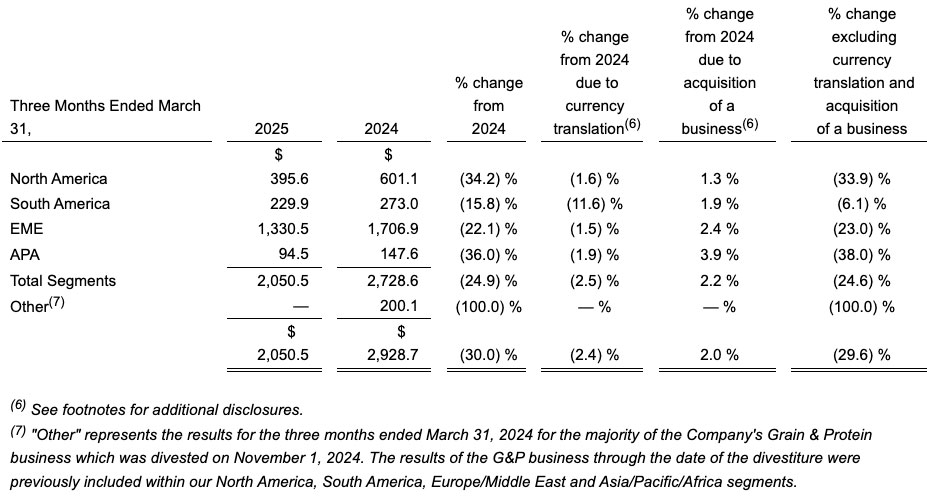

AGCO sales worldwide for the first quarter ended 31 March 2025 tallied US$2.1 billion, a decrease of 30.0% when compared to the first quarter of 2024.

All the majors are in the same predicament, the only difference is to what level of red ink sales are deteriorating.

This downward trend for farmers worldwide, being very cautious with their purchases, will only worsen when the Trump administration tariffs kick in.

Since the Trump tariffs were announced on 2 April 2025, it has created the most uncertainty surrounding trade in peacetime ever witnessed, and as a result, shipping activity into US ports had severely declined by late April and early May.

Many manufacturers have already laid plans to implement price increases and surcharges as they come to terms with the economic weight of the tariffs.

In some cases, vital parts and components for US farmers were turned back on the high sea to avoid tariffs of up to 145%, with all further shipments from China expected to be cancelled in the short term.

So it must be said that any predictions made by AGCO relating to first quarter 2025 sales, not yet affected by tariffs, could differ from full year US$9.6 billion net sales.

AGCO executives did indicate the outlook reflected lower sales volumes from assumed actions to mitigate tariff impacts, and as a result, the forward estimates reflect the projected impact of tariffs in place as of 1 May 2025.

Further changes to Trump or reciprocal tariffs engaged by other trading nations or other actions in response to them could result in changes to these estimates.

From the AGCO desk

Eric Hansotia, AGCO chairman president and CEO had this to say, “AGCO performed well in the first quarter, which better positions us to navigate global trade uncertainties and continued weak industry demand.

“We made substantial progress in our cost reduction efforts while reducing inventory by cutting production hours in the quarter by approximately 33% year-over-year.

These decisive actions, coupled with our focus on driving retail sales, allowed us to improve dealer inventory levels in both North and South America.”

Eric Hansotia continued, “We are seeing a mix of positive signs and risks around the world, requiring us to remain agile as we execute our Farmer-First strategy.

“The underlying fundamentals in many parts of the world have begun to trend upward with farmer sentiment in Europe improving, US corn prices rising and corn stocks-to-use-ratios at lower levels.

“However, the global agricultural equipment market is volatile due to tariffs and shifting export demand for grain.

“As we look around the world, the US may face reduced market access for key exports, while South America is likely to ship more to China. Although US net farm income forecasts have been revised higher on government aid, increased subsidies are not expected to boost demand for farm equipment in the near-term.

“Brazil’s record soybean production and delayed corn planting highlight both growth potential and risks. Persistent rain and poor growing conditions have negatively impacted wheat production across Western Europe with reduced yields reported in several countries.

“Demand for new equipment has softened further in North America and Europe as a result of volatile crop producer demand,” Eric Hansotia concluded.

North America

AGCO net sales in North American decreased by 33.9% in the first three months of 2025 compared to the same period in 2024. Softer industry sales and under-production of end-market demand contributed to lower sales.

The most significant sales declines occurred in high-power tractors, sprayers and combines. Income from operations for the first three months of 2025 decreased by US$48.2 million compared to the same period in 2024 while operating margins were 5.0%.

South America

Net sales for AGCO models in the South American region decreased 6.1% in the first three months of 2025 compared to the same period in 2024.

This was in part brought about by softer industry retail sales, and under production of retail demand, while lower sales of high-power tractors and planters accounted for most of the decline.

Income from operations in the first three months of 2025 decreased by US$9.9 million compared to the same period in 2024. This decrease was primarily a result of lower sales and production volumes as well as negative pricing.

Europe/Middle East

AGCO net sales in Europe/Middle East regions decreased 23.0% in the first three months of 2025 compared to the same period in 2024.

Lower sales across most of the Western European markets were partially offset by growth in Spain and Eastern Europe. Declines were largest in high-power and mid-range tractors as well as hay equipment.

Income from operations in Europe/Middle East regions decreased US$140.7 million in the first three months of 2025, compared to the same period in 2024.

Asia/Pacific/Africa

It was a noticeably disappoint result in the margins with net sales in the Asia/Pacific/Africa region decreasing by 38.0%, in the first three months of 2025 compared to the same period in 2024.

Much weaker farmer market demand and lower production volumes resulted in lower sales in Australia and Japan, while China was responsible for most of the decline.

Income from operations in the Asia/Pacific/Africa region decreased by US$11.8 million in the first three months of 2025 compared to the same period in 2024 primarily due to lower sales and production volumes.

AGCO outlook for 2025

As previously announced, AGCO’s net sales for 2025 are expected to be approximately US$9.6 billion, reflecting lower sales volumes and assumed actions to mitigate tariff impacts.

Adjusted operating margins are projected to be 7% to 7.5%, reflecting the impact of lower sales, lower production volumes, increased cost controls and flat engineering expenses.

These full-year estimates reflect the projected impact of tariffs in place as of 1 May 2025 across the Company’s various jurisdictions, along with their planned mitigation actions. Changes to the tariffs or other actions in response to them could result in changes to these estimates.

AGCO net sales by region (US$ millions)