CNH has shrugged off a Q1 2025 sales dip of 23% and replaced that sentiment with a plan during Investor Day 2025 that would make any investor happy

When CNH Industrial released its quarter one 2025 sales results, it had the company in line with just about every other farm equipment manufacturer, scraping along with the weight of heavy sales dips.

However, with farm equipment investors used to the vagaries of drought and farmers bunkering down during hard times, the CNH Investor Day 2025 gave everybody the ammunition they needed to charge into the future.

First, let’s look at the base CNH Industrial is working from, the first quarter of 2025, worldwide sales.

CNH Industrial ended the three months up to 31 March 2025, with net income of US$132 million, compared with net income of US$369 million for the same three months in 2024.

This is a result of consolidated revenues down 21% to US$3.83 billion when compared to Q1 2024, while net sales were $3.17 billion, down 23% compared to Q1 2024.

A close look at agriculture-based models revealed a net sale decrease in the quarter of 23% to US$2.58 billion, when compared to the same period of 2024.

No doubt due to decreased farmer demand across all regions and the resultant dealer destocking.

CNH forecasts that 2025 global retail sales will be lower in both the agriculture and construction equipment markets when compared to 2024. In addition, CNH is focused on driving down excess channel inventory primarily by producing fewer units than the retail demand level.

With the company offering a full-year outlook of agriculture segment net sales down between 12 and 20% year-over-year thrown into the mix, sales results moving ahead were beginning to look grim.

That was until CNH Industrial presented a Strategic Business Plan that will take the company into 2030 with a strategy to deliver strong growth, in tandem with cost efficiency targets.

And above all, consolidate its agriculture badges to be positioned as the number 1 or 2 player in all major world markets.

CNH’s Strategic Business Plan

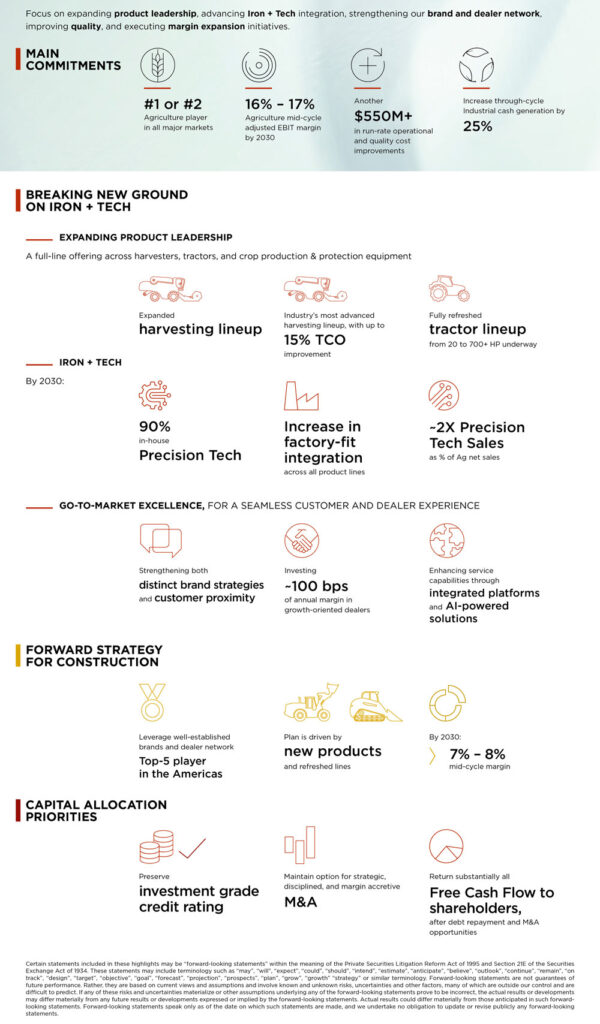

CNH is targeting a 16 to 17% agriculture mid-cycle adjusted EBIT margin by 2030.

This ambition is expected to be achieved through a combination of margin expansion initiatives tied to commercial growth and operational efficiency.

Specifically, CNH expects to generate margin expansion through commercial growth initiatives that consist of Precision technology product mix and go-to-market actions.

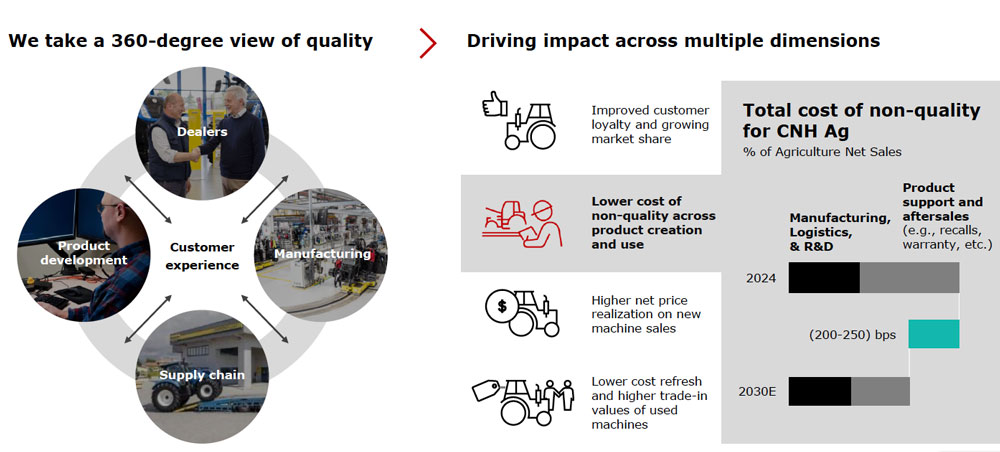

These will include operational efficiencies relating to strategic sourcing, plant efficiencies, and advanced manufacturing processes, and quality enhancements driven by greater product reliability and stronger dealer partnerships.

CNH says it is committed to delivering in excess of US$550 million in operational and quality cost improvements by 2030 to support this margin expansion.

Much is expected to be achieved with a go-to-market strategy that will be centered on an integrated and regionally tailored dealer network and brand strategy.

CNH has outlined how it wants to drive higher farmer engagement with a greater focus on better and faster customer service through its existing global network, which is industry-leading in terms of customer proximity with 6,000 points of sale and service.

Central to this strategy is the strengthening of leading badges, Case IH and New Holland as global brands and STEYR as a dedicated European brand, each serving distinct customer segments.

Tractor badges to flourish

As expected, the key pillars in advancing the CNH model range are the further integration of models with technology, which will, in turn, boost precision farming to a predicted point of nearly double the current net sales in this sector.

While the most notable of all reveals is the strengthening market approach of a new CNH dual-brand dealer strategy.

According to CNH, crucial to the strategy is the establishment of a ‘New Deal’ with dealers, which will see the company invest 100 bps (a basis point is equivalent t0 1%) of annual margin over the next five years in growth-oriented dealers.

We have already seen this scenario working through local dealers taking on both Case IH and New Holland-branded models, read more here.

CNH says it is also investing in enhancing customer-centric service capabilities through integrated platforms and AI-powered solutions for programmed and predictive maintenance.

Along with increased connectivity for units, and retrofit solutions to deliver a seamless customer and dealer experience that targets 100% uptime and a ‘fix right the first time’ guarantee.

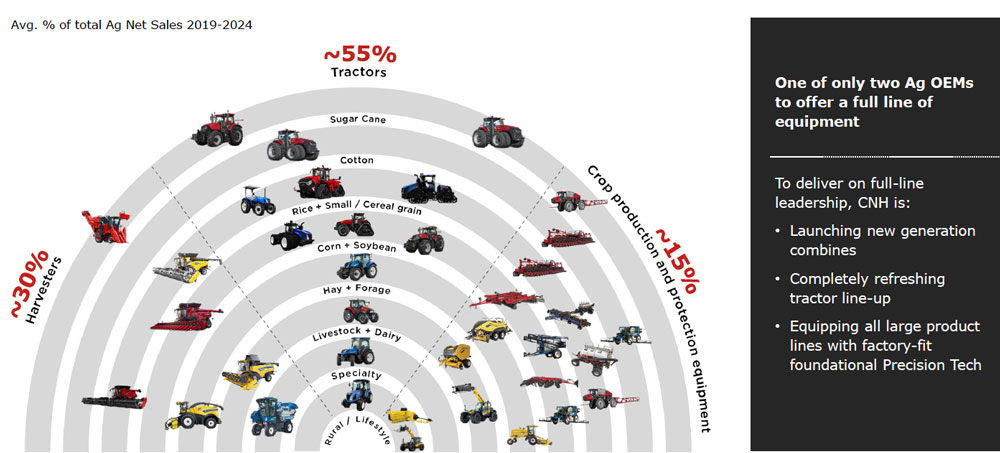

To gain or consolidate its position as the first or second agriculture player in all major markets during the plan period, CNH management has advised it will work to strengthen its product lines across all phases of the agricultural cycle.

This will include new model launches, updates and added functions for tractors, harvesters, crop production and crop protection equipment.

CNH already offers some of the industry’s most advanced and sophisticated combine harvesters, and we will further expand their harvesting line up to maintain a leading position.

Part of this will be through the new generation twin and single rotor combines launched in 2024, that are delivering a 15% lower total cost of ownership.

And a full refresh of the tractor line up covering the 15 to 515kW+ (20 to 700+) power segments is already underway, and from 2026 onwards, CNH will continue to progressively introduce additional product lines.

Precision technology expansion

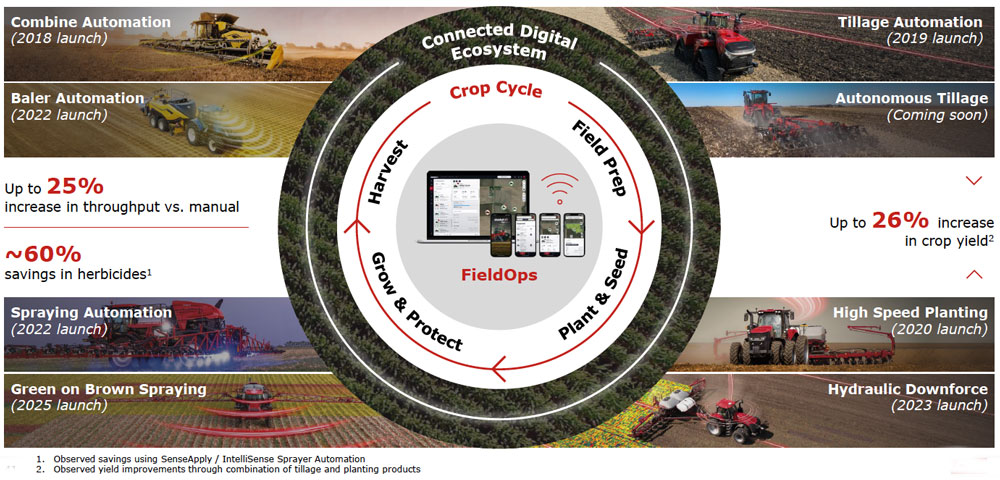

Through a major investment in technology, CNH will adopt and embed advanced Artificial Intelligence (AI) capabilities into all model lines to create the best user experience for farmers through seamless integration.

Precision tech offering will include agronomic sensors, smart implements, advanced automation, autonomous features, satellite connectivity, agronomic insights, and machine data synchronisation via the FieldOps™ digital platform.

Precision technology systems will be installed as factory-fit across all major model lines, as well as focusing on increasing integration across all products. By 2030, 90% of these systems will be developed in-house.

By the end of the plan period, the contribution of Precision technology sales will nearly double as a percentage of total agriculture net sales, driving additional margin.

CNH construction model advancement

The CNH construction arm is independent of agricultural sales and already recognised as a business with a well-established model range.

The role construction will play in the Strategic Business Plan will be to pursue continued margin expansion and turnaround.

Strategic actions are in place to leverage the strengths of our well-known models within CASE Construction Equipment, New Holland Construction and Eurocomach. Selling through a widespread global network, and holding a top-five position in North and South America.

Continued growth and market share gains for construction models will be driven by new product launches, updates to existing product lines, integrated digital technologies and increased aftermarket sales through an enhanced distribution network.

Through-cycle margin expansion will be achieved with manufacturing and sourcing efficiencies as well as aftermarket growth through parts and connected services unit.

Adding to CNH construction’s position of strength are the cost efficiencies the company says they will continue to generate, creating capacity for future growth investments.

The CNH construction division is targeting a 7 to 8% mid-cycle adjusted EBIT margin by 2030. Planning to specifically generate this margin through expansion, sourcing improvements and manufacturing improvements.

What the CNH Strategic Business Plan expects to deliver