John Deere models may be leading the way out of the tractor sales slump with a 16% drop for Q2 much better than the 30% drop in Q1

The John Deere badge may be leading farm tractor and equipment manufacturers out of the sales-drop doldrums. The three-month second quarter sales results, revealed at a 16% decrease, a big improvement on the first quarter’s devastating 30% drop.

It may sound odd to anyone outside the tractor industry, but a Worldwide net sales and revenues decrease of just 16% to US$12.763 billion for the second quarter of 2025 is a step in the right direction.

And even better for Deere, stock market watchers clambered to compliment the covert the company by sending shares up 5%, mainly due to the cost-saving measures and inventory Deere management has implemented.

The John Deere badge, along with all others, is faced with farmers baulking at high prices for tractors and harvesters, and in some sectors, weaker crop prices deterring them from buying new models.

Deere management has been able to cushion the blow from softer demand by reducing production and warranty-related expenses.

But of course, good management will be tested further as Trump administration tariffs begin to add to production costs with extra levies liable to cost Deere more than US$500 million in 2025 before taxes.

Deere’s core business would have remained unchanged on a global basis, without tariff imposts that have seen the world’s largest agricultural equipment maker reduce its annual net income forecast to between US$4.75 billion and US$5.5 billion, compared to a pre-tariff forecast of US$5 billion to US$5.5 billion.

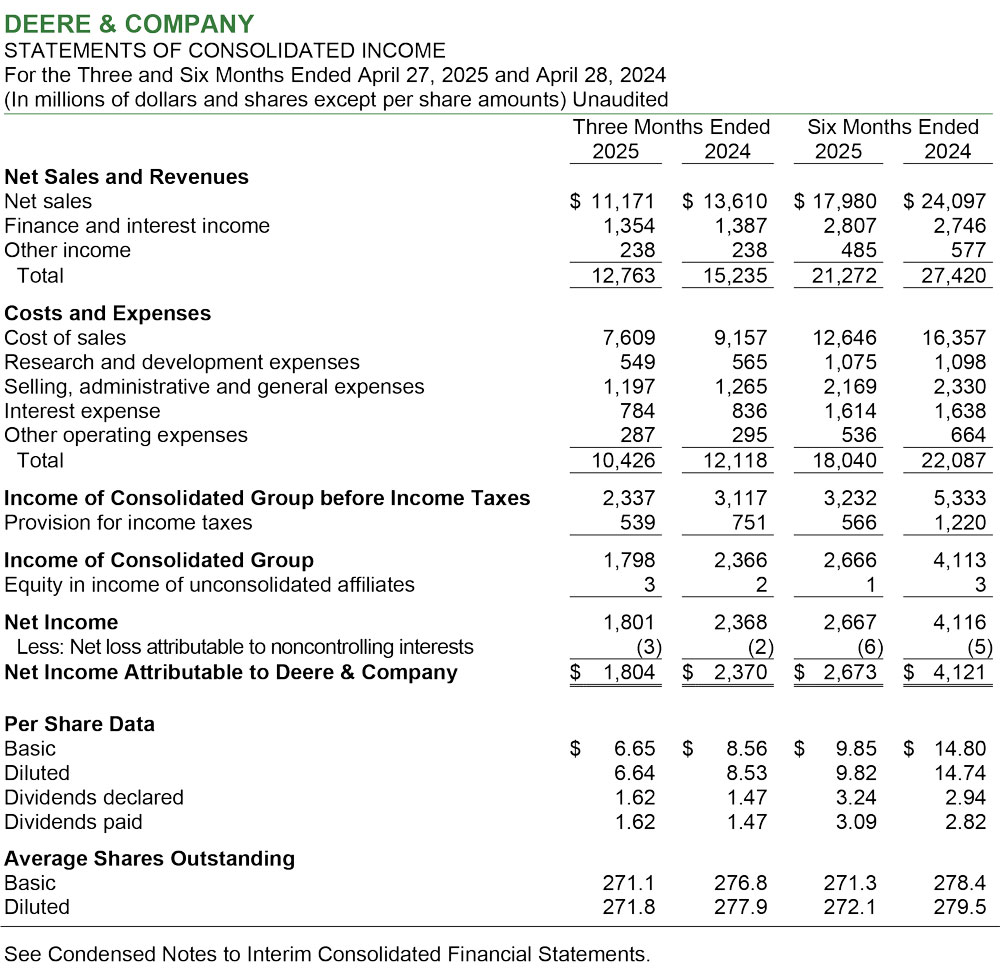

Deere & Co sales and income results for 2025

From net sales of US$11.171 billion for Q2 2025, production equipment and precision agriculture sales were US$5.23 billion, a drop of 21%.

While small agriculture and turf sales registered a much smaller 6% decrease for the quarter to US$2.994 billion. While construction and forestry sales decreased by 23% to US$2.947 billion.

Deere & Company managed to bank net income of US$1.804 billion for the second quarter of 2025. This compares with the net income of US$2.370 billion banked for the same period in 2024.

When comparing net income for the first six months of the year, Deere & Company has accumulated US$2.673 billion for 2025, compared with US$4.121 billion for the same period last year.

Adding the two completed quarters for 2025, worldwide net sales and revenues for the first six months of 2025 averaged a decrease of 22% to US$21.272 billion.

Deere & Company expect considerable differences between their world markets in 2025 with large agriculture models in the US and Canada tipped to fall by 30%, while small Ag and turf in the same market are expected to be down by 10 to 15%.

With other world markets faring much better with Europe only down by 5%, while South America and Asia are expected to remain steady.

Meanwhile, the John Deere construction and forestry division is expected to cling in with US and Canadian sales down by 10%, while overall global sales are estimated at 10 to 15%.

However, a cautionary provision is added to this Deere & Company outlook, while it incorporates the impacts from global import tariffs that are in effect as of 13 May 2025.

Due to the uncertain global trade environment, the potential impacts of future tariffs are not included in the outlook.

John May, chairman and CEO of John Deere had this to say, “As we navigate the current environment, our customers remain our top priority. I’m incredibly proud of our team’s execution for quarter 2, delivering exceptional performance despite challenging market dynamics.

“Their dedication and hard work have been instrumental in ensuring our customers continue to receive the high-quality service and products they expect from John Deere.

“Despite the near-term market challenges, we remain confident in the future. Our commitment to delivering value for our customers includes ongoing investment in advanced products, solutions, and manufacturing capabilities.

“Over the next decade, we will continue to make significant investments in our core U.S. market, underscoring our dedication to innovation and growth while focusing on remaining cost-competitive in a global market,” John May added.

See how the Q2 John Deere sales result compares to main competitors AGCO on this link, and CNH on this link.

Deere & Company consolidated income Q2 2025