CNH management is confident it has everything in place to improve on the Industrial Q2 sales result of US$4.02 billion that was down 16% compared to Q2 2024

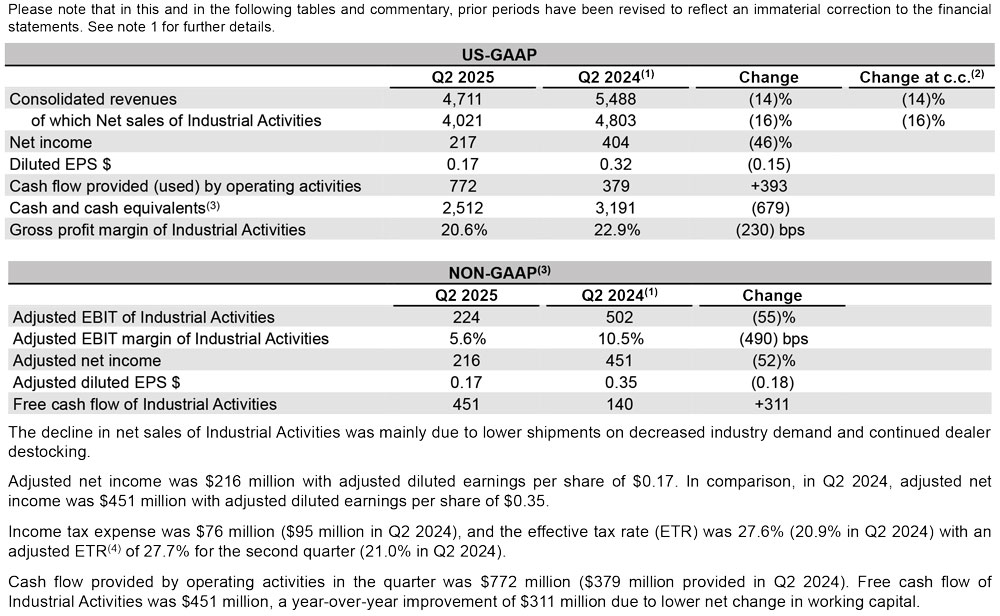

CNH Industrial, best known for its Case IH and New Holland badges, today reported sales results for the three months ended 30 June 2025, Q2, with consolidated revenue of US$4.71 billion, down 14% compared to Q2 2024, while net sales of Industrial Activities were US$4.02 billion, down 16% compared to Q2 2024.

This represents an improvement over the 23% net sales dip in Q1, see story here and follows a current general trend of slight improvement for farm equipment sales in some world markets.

And according to CNH Industrial management, these results reflect their ongoing execution of cost-saving initiatives that have partially offset market headwinds to be able to return US$0.3 billion to shareholders through dividends.

One massive glean from the results was the advice management has reaffirmed the full-year guidance levels issued previously for 2025.

Gerrit Marx, Chief Executive Officer,stepped up the rhetoric, “While we continued to face challenging market conditions this quarter Q2, the CNH team’s resilience and dedication allowed us to navigate through them effectively and in line with our targets.

“We remain focused on the strategic priorities we outlined at our recent investor day to advance our operational improvements and investments that deliver exceptional products and technology for our farmers and builders.

“We appreciate the support from our suppliers as we navigate uncertain trade waters, and from our dealer network, which strives for unmatched customer service as we position CNH for long-term success. I am excited about the future of CNH and look forward to sharing the journey ahead with you all,” Gerrit Marx concluded.

CNH Industrial Quarter 2 results

All amounts US$ million, comparison vs Q2 2024 – unless otherwise stated

CNH Industrial 2025 Outlook

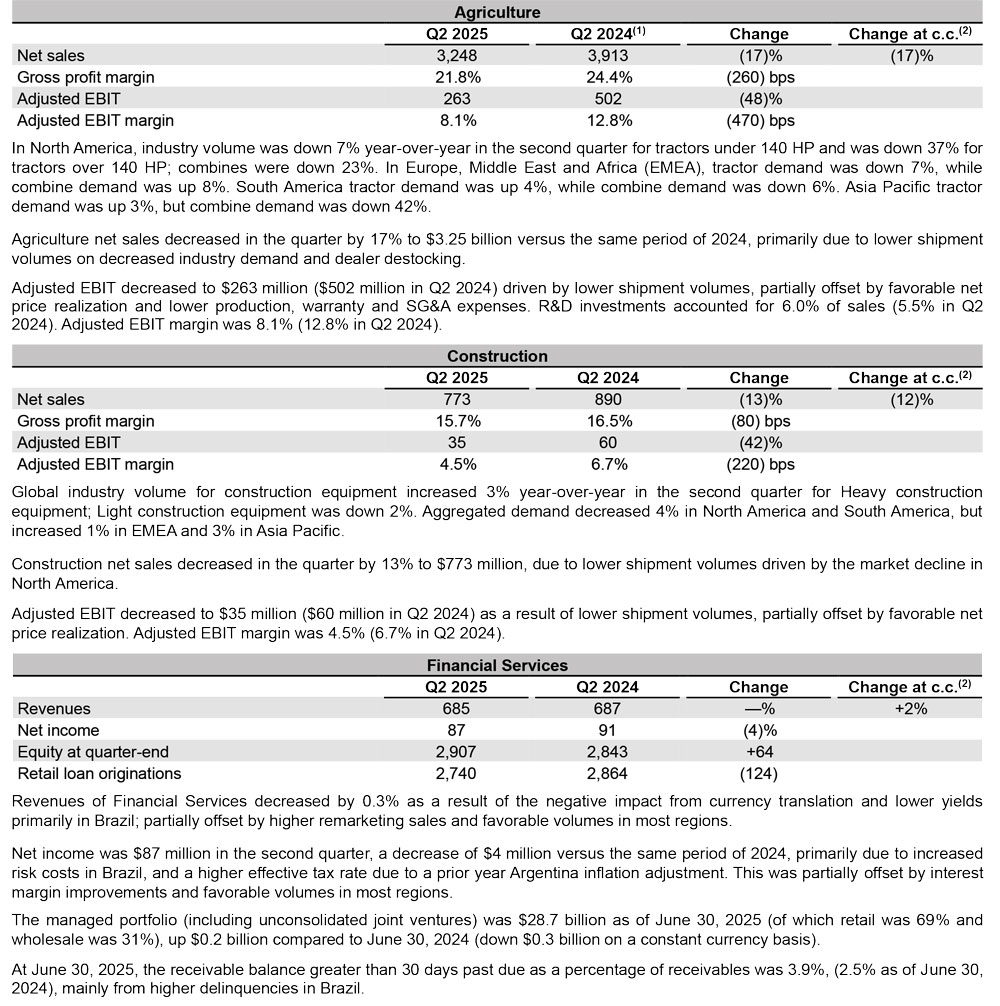

The Company continues to forecast that 2025 global industry retail sales will be lower in both the agriculture and construction equipment markets when compared to 2024. CNH is still focused on driving down excess channel inventory primarily by producing fewer units than the retail demand level, which will result in 2025 net sales being lower than in 2024.

The lower production and sales levels will negatively impact CNH Industrial segment margin results. However, the Company’s ongoing efforts to reduce its operating costs will partially mitigate the margin erosion.

CNH is continuing its focus on product cost reductions through lean manufacturing principles and strategic sourcing. The Company is also carefully managing its SG&A and R&D expenses.

In addition to the lower cyclical industry sales, the Company is navigating a changing global trade environment. The uncertainty of the US trade policy, the reactions of trading partners, and the impact to CNH end customers may affect the company’s forecast for the year.

The Company is reaffirming its previous 2025 outlook: Agriculture segment net sales down between 12 and 20% year-over-year, including -1% of currency translation effects. Agriculture segment adjusted EBIT margin is between 7 and 9%.

Construction segment net sales down between 4 and 15% year-over-year, including -1% of currency translation effects. The construction segment adjusted EBIT margin is between 2 and 4%.

Free cash flow of Industrial Activities(6) between US$100 million and US$500 million. Adjusted diluted EPS(6) between US$0.50 to US$0.70.