Elders delivered across key business segments with real estate services offsetting any dips in rural store retail conditions affected by early season drought

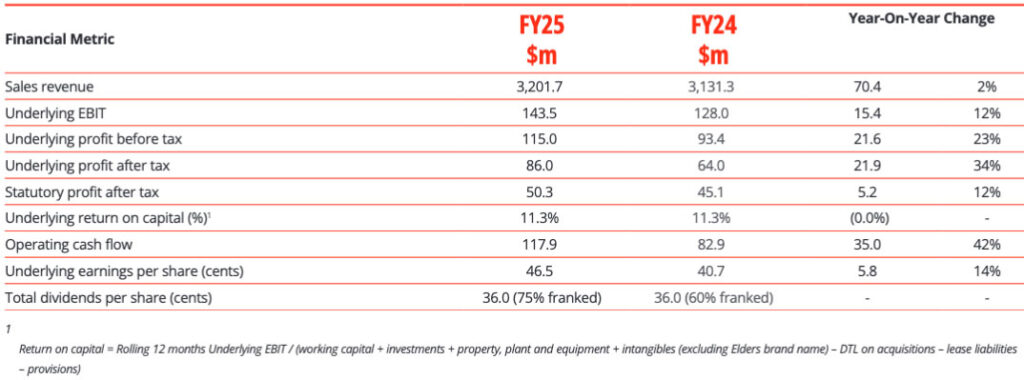

When Elders delivers its full-year results at their AGM in December, directors expect plenty of pats on the back with the announcement of $143.5 million underlying earnings before interest and tax (EBIT), and a final dividend of 18.0 cents per share, 100% franked.

This is the news investors want to hear as Elders Limited recaps its results for the 12 months to 30 September 2025.

Key takeaways for investors were a reported 12% increase in underlying EBIT to achieve the $143.5 million earnings and a 34% rise in underlying net profit after tax, supported by sales revenue growth to $3.20 billion. Compared to $3.13 billion in 2024.

And the news that Elders is aiming for 5 to 10% growth in EBIT and EPS from improved retail operating system and expansion in financial and real estate services. See an example of an Elders store modernisation on this link.

Investors will have taken note of Elders’ performance throughout FY25 when the company demonstrated strong operational and financial resilience in the face of mixed seasonal conditions for several farming regions, with South Australia and Victoria in particular facing severe dry conditions.

Elders’ diversified portfolio, through its national geographic footprint and multi-product offering, played a key role in mitigating the impact of dry conditions across key regions, with stronger activity in livestock and real estate supporting overall results.

Across FY25 the result turned out well, for all, with the Directors determined to pay a final dividend of 18.0 cents per share, 100% franked.

Elders explains sales conditions

Retail Products gross margin declined compared to last year, due to continued localised competition, exacerbated by dry conditions particularly in South Australia and western Victoria.

The most significant decrease was attributable to crop protection gross margin, resulting from lower sales and competitive pressure. Strong sales performance in fertiliser and animal health partially offset this impact in gross margin.

Wholesale Products margin was stable compared to last year. Despite an uplift in sales, gross margin percent declined, impacted by product mix and competitive pressure in the crop protection wholesale market exacerbated in dry regions.

Agency Services gross margin increased as livestock continued to outperform with significant uplifts in price for cattle and sheep, and higher cattle volumes, as greater de-stocking occurred in drier regions.

Wool gross margin saw ongoing improvement, with the full year benefits from Elders Wool partly driving upside in earn per bale. This was partially offset by lower bales sold, in line with reduced global demand for wool as producers continue to await a market recovery.

Real Estate Services gross margin improved compared to last year, with the IPST Holdings (previously operated as Knight Frank Tasmania) acquisition providing a full year benefit to prior year.

There was continued organic growth across all key service categories, supported by improving seasonal conditions and stronger commodity prices, as well as recent interest rate cuts supporting demand for rural and residential properties.

Financial Services gross margin increased compared to last year, with outperformance across most categories offsetting part year earnings from the finalisation of the Rural Bank relationship agreement.

Gross margin from livestock related products continued to increase in line with improved livestock conditions, supported by growth in the recently established Elders Finance employed broker model (encompassing commercial, agriculture, and asset finance loans).

Feed and Processing Services’ gross margin grew compared to last year, largely attributable to increased cattle throughput, as well as production efficiencies gained through the recent investment in a modern feed mill. This resulted in higher average daily weight gain and a reduction in downtime.

Elders FY26 Outlook

Elders is optimistic about the outlook for FY26, supported by a forecast recovery from dry conditions in South Australia and Victoria, as well as the commencement of benefits following implementation of their new retail system.

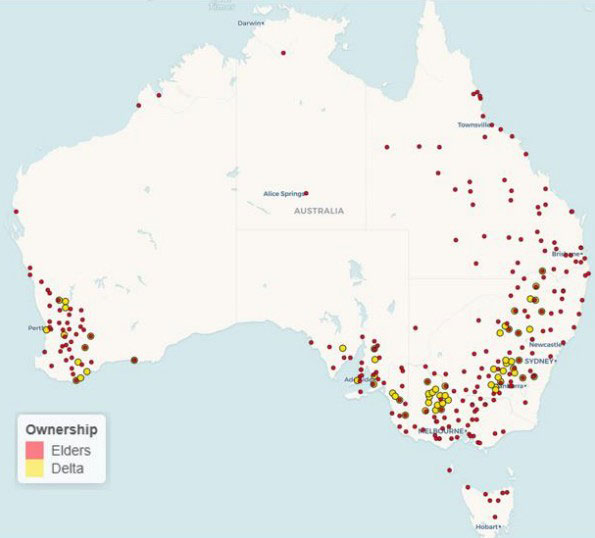

In addition, the purchase of Delta Agribusiness by Elders, will expand their Rural Products business in FY26. See the Delta buyout story here.

Elders suggests the outlook and fundamentals for livestock remain sound, with prices for sheep and cattle forecast to be supported by strong international demand against a backdrop of tightening supply, especially from regions recovering from drought.

According to Elders the outlook for the regional residential property market remains positive, benefiting from the stabilisation of interest rates at lower levels.

Elders says it will continue to invest in strategic initiatives, in line with its Eight Point Plan, while maintaining a focus on cost and capital efficiency.

This will be facilitated by Elders newly implemented divisional model, effective 1 October 2025, which enables the business to be well-positioned for future growth and efficiency across its diversified portfolio.

Looking at results and the future

“In FY25, Elders once again demonstrated the strength and resilience that has defined our 186-year legacy in Australian agribusiness,” said Mark Allison Elders CEO and MD.

“Despite mixed seasonal conditions, we delivered strong safety improvements, reduced our Total Recordable Injury Frequency Rate to industry-leading levels, and maintained disciplined financial performance.

“Our strategic acquisition of Delta Agribusiness and continued investment in systems modernisation highlight our commitment to sustainable growth and innovation. As we enter FY26 with a refreshed company structure and clear direction, I am optimistic about the opportunities ahead.

“Elders is well-positioned to deliver stable, methodical performance and to grow alongside our clients and communities, supported by our excellent people,” Mark Allison concluded.