There will still be an estimated 128,000 metric tons of avocado fruit in the alternative 2024-25 season with 170,000 metric tons tipped for season 2025-26

Avocado growers are used to the seesaw in production, where every second season takes a breather and can produce up to 25% less than the previous season.

This is a phenomenon within Avocado production of ‘alternate bearing’ where trees can produce a large crop one year, followed by small or no crops the next.

The dip for the alternative season 2024-25 crop is estimated to be down 15% on last year, according to a just-released report.

This drop in our booming ‘avo’ production is expected to be short-lived, according to the report by the agribusiness banking specialist’s RaboResearch division, as local production is forecast to rebound to record volumes, of around 170,000 metric tons, in season 2025-26.

And even with the decline in this year’s production, there will still be plenty of avocados to go around, says RaboResearch analyst Anna Drake, with local growers estimated to produce 128,000 metric tons of the fruit in the 2024-25 season, which equates to close to 20 avocados per person a year.

Meanwhile the world’s appetite for avocados continues to grow at a rapid rate, with the global market ‘smashing’ the US$20 billion (AU$30 billion) mark for the first time.

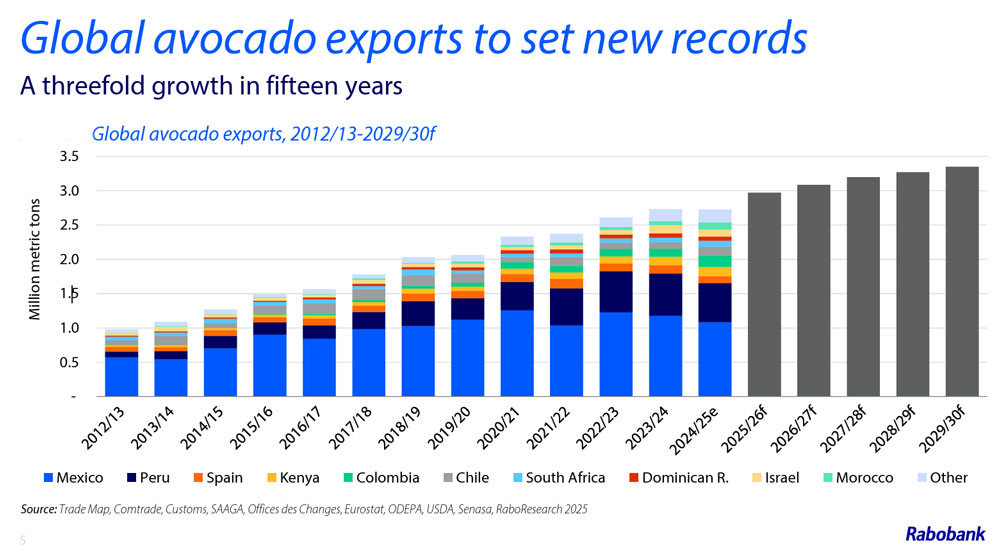

And global avocado export volumes are expanding rapidly, according to Rabobank’s Global Avocado Update 2025.

Local grower boom

RaboResearch analyst Anna Drake said growth in new “bearing acreage” (avocado trees coming into production) in Australia is starting to slow, with new avocado planting at its peak in 2019, now in full production.

“New avocado planting has continued to drop off sharply,” Anna Drake conveys. “Avocado tree planting in 2024 was at its lowest level since 1999 and down over 90% from the highs in 2019, signalling the beginning of a levelling-off in crop size.”

Anna Drake explained further that while local avocado production is expected to rebound next year, with many alternate-bearing trees set to have an ‘on’ production year, longer term, the production growth rate is likely to slow, reflecting a stabilisation in supply.

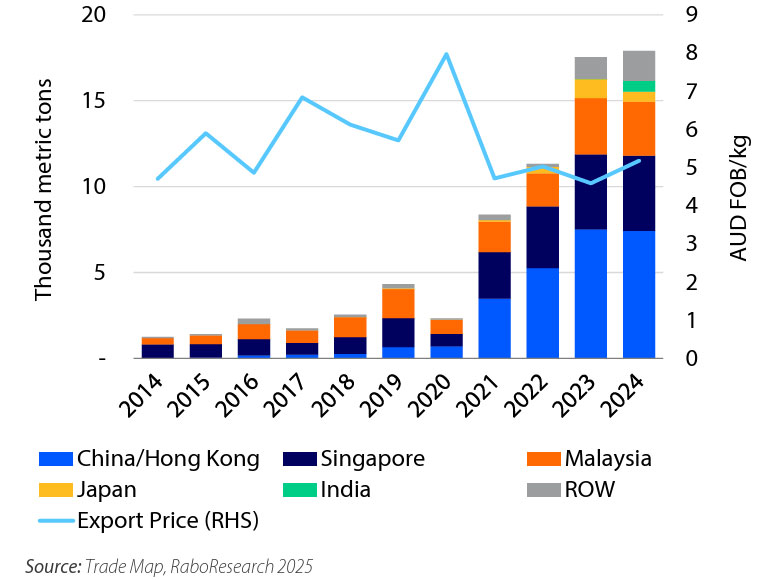

The report detailed how Australian avocado export volumes remained flat in 2024, but export prices improved for growers, up 13% year-on-year to AU$5.18/kg.

“Export volumes to the major destinations of China, Singapore and Malaysia remained almost unchanged year-on-year, while those to India increased sharply after improvements in market access,” Anna Drake revealed.

Adding that over the past five years, Australian avocado exports have shown impressive growth, with 10 to 15% of production volumes now moving into export channels.

Anna Drake also said following the anticipated rebound in our local avocado production next season, continued export growth across key markets will be a critical factor in easing downward pressure on prices for the industry.

The Rabobank Global Avocado Update for 2025 clearly indicates a growth trend and solid returns out to season 2029-30

Global markets in growth phase

The report also outlined how the global avocado market continues to grow, with an average annual market value, in terms of consumer prices, now estimated at US$20.5 billion (more than AU$30 billion).

RaboResearch senior horticulture analyst David Magaña highlighted how three main regions represented 88% of this market value, Latin America, North America and Europe.

While Latin America leads global consumption, the market value in the rest of the world is still low, at 12%, he indicated, presenting growth opportunities.

North America had seen a significant increase in avocado demand growth in the past two decades, led by marketing campaigns.

Globally, avocado export volumes are growing rapidly, RaboResearch outlined, driven by increased production and diversification of exporting countries. Amid this rise of new suppliers, seasonal oversupply in certain markets is a concern that will require continued demand creation and marketing strategies.

RaboResearch expects global avocado exports to continue to expand across the next few seasons.

“We estimate global avocado exports will surpass three million metric tons by 2026/27, a significant increase from one million metric tons in 2012/13,” David Magaña confided. “This massive growth is the result of increasing exports from the current top three avocado exporters, Mexico, Peru and Colombia, accounting for about two-thirds of global exports.”

Another factor, the report refers to, is the continued diversification of growing regions and the appearance of more exporting countries. Attracted by high margins in recent decades, new players are producing and exporting avocados, although pressure on margins is growing.