Local beef production is expected to rise in the second half of 2023 following two seasons of herd rebuilding

Australia’s beef production is forecast to rise by 6% through the second half of 2023, with output to sit in line with the five-year production average, according to the latest Rural Bank report.

This comes on the back of rising cattle availability following the last two years of herd rebuilding.

The increase in beef production will continue to provide a strong surplus of beef available to be exported over the next six months.

While a potential risk to the higher supply of beef production is limited labour availability which may restrict the rate at which slaughter could increase, though with labour supply expected to continue rebounding over the next six months, this risk remains relatively minor.

Global beef production is expected to increase throughout the second half of 2023 as the fall in US production is matched by gains in Australian, Brazilian, and Chinese beef production.

Brazil’s production is forecast to rise 2% as lower calf prices and a stronger domestic market push slaughter rates higher.

The USDA is forecasting US supply will decline by around five per cent across the remainder of 2023, as the cattle herd has decreased following the large culling rates in late 2022 and early 2023 driven by drought conditions across key US grazing areas.

Demand is the key

Domestic demand for Australian beef is likely to soften marginally throughout the second half of 2023. The continued weight of inflationary pressures is expected to decrease discretionary spending for consumers, which will affect higher end beef products.

The dry weather outlook is also expected to affect pasture availability and re-stocker demand is also likely to soften in key cattle regions across the country as the herd rebuild reaches maturity.

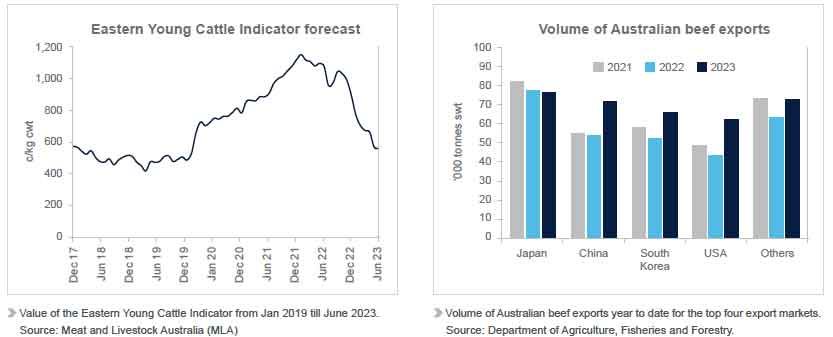

Global demand for Aussie beef is expected to rise throughout the second half of 2023. This comes on the back of a decline in US production which will create export opportunities into key markets including China, Japan, South Korea and the US itself.

With China’s COVID restrictions now removed it is likely that their domestic demand will rise over the next six months, further providing export opportunities.

The implementation of the A-UKFTA at the end of May provides another possibility for a rise in demand for Australian beef, particularly over the longer term.

Local beef producers now have access to a duty-free quota of 35,000 tonnes in the first year as a result of the agreement. This follows a maximum limit of 3,761 tonnes in previous years with prohibitive tariffs outside of this quota.

The improved market access is providing an especially positive outlook for local producers over the coming years as restrictions on exports begin to ease, however as mentioned this remains a longer-term benefit and is not likely to translate to a significant increase in beef exports to the UK over the next six months.

Producers hang out for price rise

Local cattle prices are likely to continue declining marginally throughout the next few months before beginning to trend upward toward the end of the year. Despite the increase in prices forecast near the conclusion of 2023, prices will remain below the five-year average.

Elevated cattle availability on the market, coupled with weaker re-stocker demand will reduce competition in markets.

However, improved opportunities in export markets on the back of reduced US supply are expected to begin offering support for price rises by the end of the year.