Deere is on a roll with increased retail prices and high demand worldwide catapulting the company toward full-year net income between US$8.75 to US$9.25 billion

It’s the badge that farmers simply can’t get enough of, as Deere & Co scrambles to deliver orders that in some lines won’t be available until early 2024.

That doesn’t seem to matter as Deere & Company reported a net income of US$1.959 billion for the first quarter that ended January 2023. As a comparison, this result compares with a net income of US$903 million, for the quarter that ended in January 2022.

This result played out following farmer support that maintained the badge in the top three brands in the major farming world markets.

As a result, net sales and revenues increased by 32% to US$12.652 billion compared to the same time last year, when net sales were US$9.561 billion for the first quarter of the fiscal year 2022.

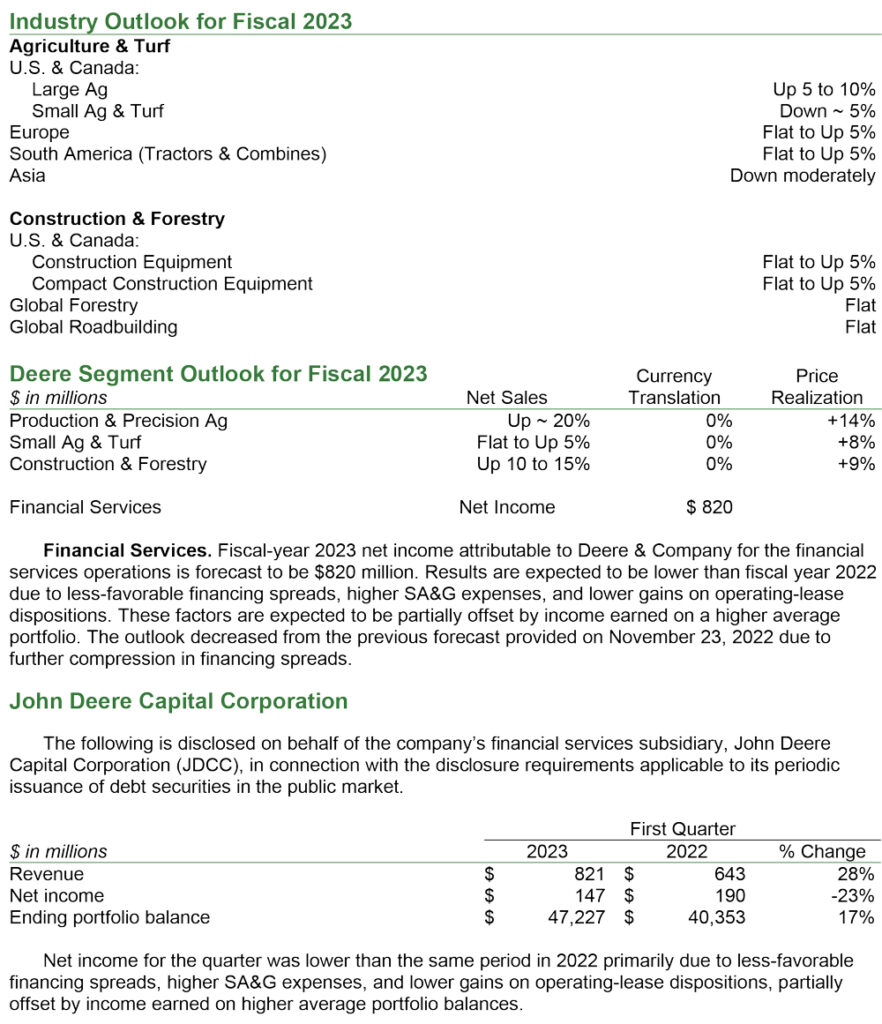

These first quarter results reveal how big broadacre models and increasing precision agriculture products led the charge with sales from this sector accounting for US$5.198 billion of the tally, leading to a solid US$1.208 billion operating profit.

While the small agriculture and turf division played its part with sales of US$3.001 billion, and that related to a handy US$0.447 billion operating profit.

In addition, the construction and forestry division showed a solid increase with net sales revenue of US$3.203 billion, a 26% increase on the same time in 2022 for a US$0.625 billion operating profit.

The balance of the income of US12.652 was due to financial services and adjustments of other revenues outside sales within the three Deere and Company divisions.

However, when comparing profit margins, it is still the original Deere and Company big iron farm models that glean the most profit for the company, broadacre and precision return an operating margin of 23.2%, with construction and forestry next with 19.5%, while small ag and turf was a tardier 14.9% result on operating margins.

Breakdown for three operational divisions

Deere and Company, Chairman and chief executive officer John C May summed up the marketplace, “Deere’s first-quarter performance is a reflection of favourable market fundamentals and healthy demand for our equipment as well as solid execution on the part of our employees, dealers, and suppliers to get products to our customers.

“At the same time, we are benefiting from an improved operating environment, contributing to higher production levels.

“Deere is looking forward to another strong year on the basis of positive fundamentals, low machine inventories, and a continuation of solid execution.

We are proud of our recent performance and remain fully committed to helping our customers do their jobs in a more profitable, productive, and sustainable way. We have confidence in our ability to execute on our leap ambitions and run our businesses with real purpose, technology, and real impact,” John C May concluded.

Expectations for the year ahead

As part of the income report, it is forecasted that the net income for Deere and Company for fiscal 2023 will be in the range of US$8.75 to US$9.25 billion.