Producers are confused about the value of their livestock pens for good reason according to a report that reveals just how highly volatile pricing can be

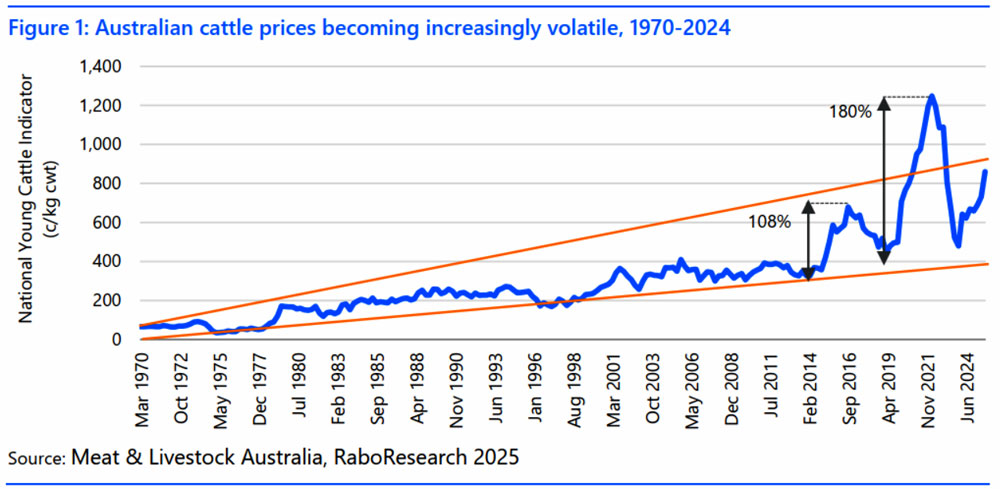

Livestock producers have been facing an unprecedented period of market volatility over recent years, with swings in cattle and sheep prices reaching record extremes according to new research.

In the report about increasing volatility in the livestock market,the bank’s RaboResearch division indicates that while volatility has long been a factor in livestock markets, both the scale and frequency of price swings have intensified significantly over the past five to 10 years.

And the agribusiness banking specialist believes this high level of volatility is likely to persist for Australia’s livestock sectors in the “short to medium term”.

In the past five years, the report details how both cattle and sheep prices have reached repeated record highs, each exceeding previous peaks by around 20%, only to then fall to the lowest levels seen in the past decade. Prices have been on another upward trend since 2023.

Report author, RaboResearch senior animal proteins analyst Angus Gidley-Baird revealed how the increased level of volatility seen in livestock markets has not been consistent across other markets, either locally or globally.

And this suggests that while macro geopolitical and economic developments do have an impact, there are particular factors affecting livestock markets that have led to this higher price volatility.

Angus Gidley-Baird explained that while there is a clear relationship between rainfall and livestock prices, with good seasonal conditions driving demand and prices higher, and dry conditions having the opposite effect, increased price volatility is not simply a reflection of more variable rainfall.

“While rainfall and confidence are important, they don’t account for the magnitude of recent price swings, while other factors including industry structure, debt levels, and global market dynamics are increasingly influential,” Angus Gidley-Baird adds.

Contributing factors

RaboResearch says a combination of these contributing factors is likely behind the extremes in livestock market volatility.

They include increased exposure to geographically larger markets, growth in information flows, an increasingly unstable global trade environment, changing industry structure and increasing debt levels. “All of which we believe contribute to increased volatility,” Angus Gidley-Baird ponders.

The report said that in recent years, the livestock sector had become more exposed to geographically larger markets, with the closure of a number of small local saleyards and the increasing presence and throughput of larger regional saleyards, as well as the advent of online sales channels.

In addition, feedlots and processors are no longer just sourcing from local markets, with the movement of cattle across state borders a common occurrence.

It is no longer just local, smaller market conditions that influence buyer and seller behaviour, but rather the larger, broader market that causes bigger market movements, the report points out.

Angus Gidley-Baird made the point that greater exposure to a wide selection of information for market participants was also likely contributing to price volatility.

“With information and sentiment flowing faster and further than ever before, producers are now reacting to a wider array of signals, from weather forecasts to global trade headlines, which amplifies market movements,” Angus Gidley-Baird adds.

The report confirmed that an increasingly unstable geopolitical environment, including a general move away from globalisation and trade liberalisation, had contributed more recently to an unstable livestock market.

“Added to this ‘complex’ is a growth in global protein consumption, increased global trade of proteins and the increased presence of diseases, which affect not only production but also trade arrangements,” Angus Gidley-Baird highlights.

In addition, the report proposes that the livestock industry has changed in structure, including becoming more “polarised” with an increasing proportion of livestock numbers in large or small farms and less in medium-sized operations.

“This leads to different decision-making,” Angus Gidley-Baird explains. “Smaller farm operations may not be driven by the same profit motives or have access to alternative income streams.

“While larger, more corporate-style operations may have different reporting responsibilities and decision-making processes, this impacts their participation in the market and possibly adds to more pronounced market movements.

“Increased debt levels and financing costs may also be contributing to livestock producers making more dramatic decisions.”

The streamlining of the supply chains, particularly for cattle, may also be a contributor to market volatility, the report says, with more livestock now going through private sales – including direct consignment to feedlots or processors – reducing the volume and quality sold through saleyards.

“Due to the more exaggerated supply and demand movements in these saleyard markets, we expect to see greater volatility resulting,” Angus Gidley-Baird confirmed.

Saleyard auction prices used for livestock market reporting have been used as a basis of this RaboResearch’s report.

Managing volatility

While volatility is not inherently negative, the RaboResearch report indicates it simply represents risk, and potentially opportunities, and it is likely to persist in the livestock sectors for the short to medium term. Industry participants should at least prepare to manage it.

“This requires a strategic approach that reinforces adaptability, promotes resilience and improves predictability,” Angus Gidley-Baird confirms.

“There is a renewed case for embedding resilience and predictability into business planning, which can help producers navigate uncertainty with greater confidence and avoid reactive decisions that may carry long-term consequences.”