If anyone owes you money now is a good time to collect as the economy is shrinking and the ability to pay in the future looks bleak for some

Moody’s Investors Service has released a report about likely loan defaults in the major Asian trading countries and has flagged where the company believes the first defaults will surface.

Titled Auto ABS – Asia Pacific: Sector Update Q3 2022 – Delinquencies will rise in some countries amid high inflation and economic slowdown the following is a summary of what the full report contains.

Moody’s Investors Service had this to say, “In Asia-Pacific, we rate auto loan asset-backed securities (ABS) in China (A1 stable), Australia (Aaa stable), Japan (A1 stable) and India (Baa3 stable).

“We forecast GDP will grow 3.2% in Australia in 2022. We have lowered our growth forecasts for China to 3.5%, Japan to 1.8% and India to 7.7% for 2022.

Moody’s added, “In the second quarter of 2022, auto loan ABS issuance volumes totalled RMB60.9 billion in China, AUD430 million in Australia and JPY22.1 billion in Japan.

In India, commercial vehicle, construction equipment and auto loans ABS issuance totalled around INR85.8 billion for the quarter ended 30 June 2022.

Moody’s gave their reasons for concern, “In China, we expect auto loan delinquencies will increase over the next couple of months, given that sporadic COVID-19 lockdowns and ongoing weakness in the property sector pose challenges to the economy.

“In Australia, we expect auto loan delinquencies will continue to increase moderately over the next quarter because inflation is increasing cost of living pressures.

“In India, commercial vehicle auto loan delinquencies will stay elevated over next three to six months, because of the negative influence of rising fuel costs, high inflation and increasing interest rates.

“In Japan, we expect auto loan delinquency and default rates to be stable this year, Moody’s added.

Moody’s noted how it is watching market trends, “We rated nine auto ABS deals in Asia-Pacific in the second quarter. We upgraded ratings for 14 tranches from four Australian auto ABS over the second quarter.

Moody’s went on to provide more details behind their predictions for the main Asian trading partners.

Macroeconomic update

AUSTRALIA

We forecast Australia’s real GDP will grow 3.2% in 2022. In the second quarter of 2022, real GDP grew 0.9% compared with the previous quarter and was up 3.6% compared with a year earlier.

Supply disruptions and price pressures constrained growth in the first quarter, while the adverse economic effects of COVID-19 lockdowns and border restrictions faded.

The Reserve Bank of Australia (RBA) has raised its policy interest rate by a 2.25 percentage points this year to 2.35% as of September, in response to elevated inflation. Inflation increased 1.8% in the March quarter and 6.1% over the year to June 2022.

Australia’s unemployment rate decreased to 3.4% in July 2022, from 4.6% in July 2021.4

CHINA

We have lowered our growth forecasts for China for both 2022 and 2023.

We forecast that the economy will grow 3.5% this year and 4.8% in 2023, down sharply from 8.1% in 2021.

Our annual GDP forecasts assume a modest recovery after weak 0.4% growth

in the second quarter and 2.5% for the first half of 2022, according to National Bureau of Statistics data.

Multiple shocks are hitting China’s economy, including the drag on consumption from the zero-COVID policy, the prolonged impact of the property sector downturn and declining export demand, all of which are curbing economic activity.

Construction spending is significantly down relative to previous years. China is also currently facing acute power outages in some regions because of drought conditions.

While the government has taken offsetting measures, including increased infrastructure spending and interest rate cuts, it is unlikely to meaningfully address the prevailing domestic demand weakness.

Labour market deterioration, especially uncertain job prospects for younger cohorts, will also likely weigh on the economy.

The surveyed unemployment rate in urban areas averaged 5.7% in the first half of 2022 and 5.8% in the second quarter. In June, the rate was 5.5%, down from 5.9% in May and 6.1% in April.

In the first half of 2022, the number of newly employed people in urban areas totalled 6.54 million.

JAPAN

In August, we lowered GDP growth expectation for Japan in 2022 to 1.8% from 2.4%, while revising up the 2023 growth forecast slightly, to 1.3% from 1.2%. In the second quarter of 2022, Japan’s real GDP expanded 0.9% compared with the previous quarter.

In Japan, recovery has been weaker than we had previously expected, with inflation of essential goods preventing a strong consumption recovery.

Even though headline inflation has risen in recent months, core inflation, stripping the energy and fresh food components, remains muted.

The central bank has reaffirmed its commitment to maintaining its current easy monetary policy stance with yield curve control in the hope of raising medium-term inflation expectations to 2.0%.

Japan’s unemployment rate was 2.6% in July 2022, compared with 2.8% in July 2021.

INDIA

In August, we lowered our calendar-year 2022 and 2023 growth forecast for India to 7.7% and 5.2% from 8.8% and 5.4% previously.

High-frequency data for the Indian economy shows strong and broad-based underlying momentum in the first four months of fiscal year 2022-23.

Services and manufacturing sectors have seen robust upswings in economic activity, according to hard and survey data, such as PMI, capacity utilization, mobility, tax filing and collection, business earnings and credit indicators.

However, inflation remains a challenge with the Reserve Bank of India having to balance growth and inflation, while also containing the impact of imported inflation from the year-to-date depreciation of the Indian rupee against the US dollar of around 7%.

In the quarter ended 30 June, India’s real GDP grew by 13.5%, compared with 20.1% growth in the same period the previous year.

Moody’s went on to discuss the current loan default rates for the main Asian trading partners and provided more details about the likely trend.

Auto loan Defaults

AUSTRALIA

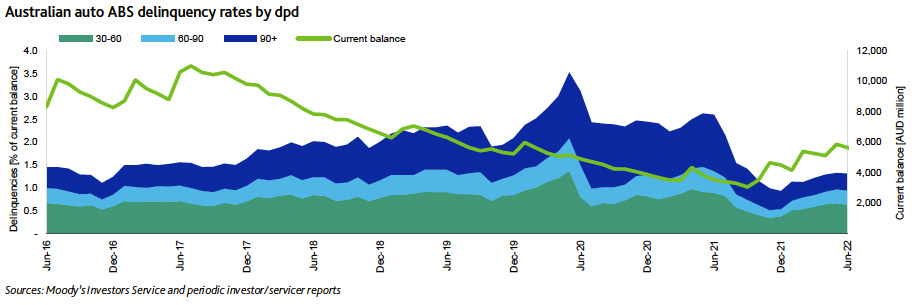

Australian auto loan ABS delinquency rates increased in June compared with March 2022. The average 30+ days delinquency rate for Australian auto ABS was 1.32% in June, compared with 1.22% in March and 2.60% in June 2021.

We expect Australian auto loan delinquencies and defaults will continue to rise moderately over the next quarter because of higher cost of living pressures.

Most auto loans are fixed rate, so the RBA’s interest rate rises will not increase rates for this debt. However, the RBA’s rate rises will add to cost-of-living pressures for auto loan borrowers who also have floating-rate residential mortgage loans.

Recovery rates on defaulted loans will be stable, because of a buoyant used car market and high used car prices.

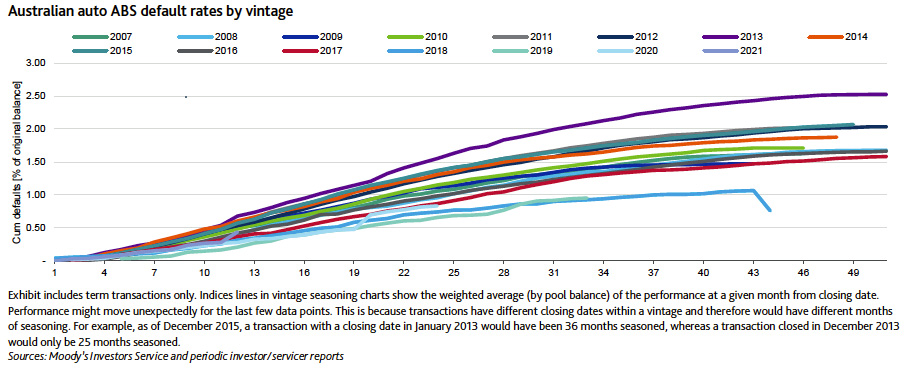

Australian auto ABS default rates range from 1.5% to 2.1% for most vintages. The main outlier is the 2013 vintage, which has a default rate of 2.5%.

CHINA

Chinese auto loan and lease ABS delinquency rates increased slightly in the second quarter of 2022, but are still low.

The average 30+, 31 to 60 and 61 to 90 days delinquency rates for outstanding deals were 0.16%, 0.09% and 0.06% respectively in June, compared with 0.11%, 0.07% and 0.04% in March.

We expect delinquencies in auto ABS portfolios will increase but stay low over the next couple of months. Sporadic COVID-19 lockdowns and disruptions to business activity, ongoing weakness in the property sector and slowing exports as global growth decelerates pose considerable challenges to the economy.

However, monetary and fiscal policy will continue to be supportive and auto ABS portfolios characteristics remain strong, which will keep delinquencies low.

Loans and leases in auto ABS portfolios have favourable credit characteristics, including amortizing repayments, minimum 15% down payments, short terms of around two to

three years and their use for the purchase of new vehicles.

The highest average cumulative default rates for 2019, 2020, 2021 and 2022 vintage auto ABS transactions are 0.48% 23 months after closing, 0.15% 19 months after closing, 0.16% 16 months after closing and 0.04% four months after closing respectively.

At any given stage of seasoning, newer vintages perform better than the fully repaid 2015 vintage, reflecting better portfolio selection by originators as they gained experience in securitization.

Cumulative default rates for the 2019 vintage are higher than all other vintages since 2015. The adverse economic effects of the coronavirus pandemic in early 2020 had a worse effect on the 2019 vintage than other vintages.

JAPAN

The annualized default rate for Japanese auto loan ABS decreased slightly to 0.29% in June, from 0.31% in March 2022.

High-quality auto loan borrowers will support auto ABS performance in 2022, with delinquency and default rates staying stable and low for most deals.

Supply chain constraints will continue to constrict the production of new vehicles over 2022, which will bolster used car prices in Japan, a credit positive for Japanese auto loan ABS.

INDIA

Collection rates for the Indian auto loan ABS we rate deteriorated marginally in the quarter ended 30 June compared with the previous quarter.

We expect collection rates will be broadly stable over the next few months.

The Indian auto loan ABS we rate did not draw on cash collateral to repay investors during the June quarter.

On an original balance basis, the 30+ days delinquency rate for Indian auto ABS we rate declined marginally to 0.51% in June from 0.56% in March 2022. The 60+, 90+ and 180+ days delinquency rates increased to 0.41%, 0.35% and 0.21% respectively in June, compared with 0.35%, 0.19% and 0.13% in March 2022.

On a current balance basis, the 30+ days delinquency rate for Indian auto ABS we rate declined to 4.62% in June from 5.15% in March 2022.

The 60+, 90+ and 180+ days delinquency rates increased to 3.75%, 3.24% and 1.90% respectively in June, compared with 3.25%, 1.76% and 1.16% in March 2022 (Exhibit 9).

We expect auto loan delinquency rates to stay elevated over the next three to six months, because of high fuel costs, high inflation and COVID-19-related medical expenses, which will weigh on borrowers’ capacities to meet auto loan