Following Titan Machinery results release it’s a clear shot across the bow for dealers to act now to reduce floor plans and drop slim-margin product lines

Since the AU$100 million takeover of the O’Connors Group 16 dealership yards by Titan Machinery at the peak of the highest farm equipment sales in our history, the giant US dealer network has been blindsided with the need to write down the value of their Australian business.

But a write-down it is, as verified in the second quarter results from the US-based giant that has more than 140 dealership locations worldwide.

Earning sales predictions from the Titan Machinery local division, formerly O’Connors Group has been slashed from a high line of US$270 million to an estimate as low as US$230 million for the full 2025 fiscal year.

Now in itself, that write-down may not look dramatic considering the vagaries encountered in the farm equipment industry, but it needs to be compared with the valuation of O’Connors 16 dealerships when Titan Machinery took over in 2023.

The US100 million purchase price was based on O’Connors Group’s annual sales of US$258 million and annual profit before income tax of US$21.4 million.

However, what has transpired since Titan Machinery took over O’Connors is a loss of US$0.5 million for the first quarter and now followed by a profit of US$1.4 million for the second quarter results. A long way off the predicted annual EBIT $US21.4 million target with two quarters already spent.

Titan Machinery executives who pushed for this foray into the Australian market can take solace from the fact we didn’t go into a long dry El Niño as predicted over this current and the past winter season.

Bad enough as it was for growers in NSW and Queensland over the past winter season, both states have made a remarkable turnaround with expectations of above-average farmgate returns from the upcoming 2024-25 harvest.

However, with the spread of Titan machinery yards an imperative factor, one state that holds more dismal prospects, South Australia only has limited exposure, while Victoria is a vital link in the success or otherwise of Titan Machinery increasing revenue from this winter season.

But at this stage farmers in both those regions are taking a more wait-and-see approach to increasing inventory as opposed to a more active role of building their farm fleets.

Since the takeover of O’Connors Group, Titan Machinery has maintained all 16 dealer yards and is positioned with ten yards in Victoria, five yards in NSW and one yard in SA.

Titan Machinery has taken over a powerhouse group in O’Connors and any short-term hiccups the local industry is experiencing at present will easily be overcome with the strong management team rolled over following the change of ownership.

Read how O’Connors became such a powerhouse selling Case IH model lines and how that meant Titan Machinery simply couldn’t resist the buyout on this link.

Titan Machinery reveals industry insight

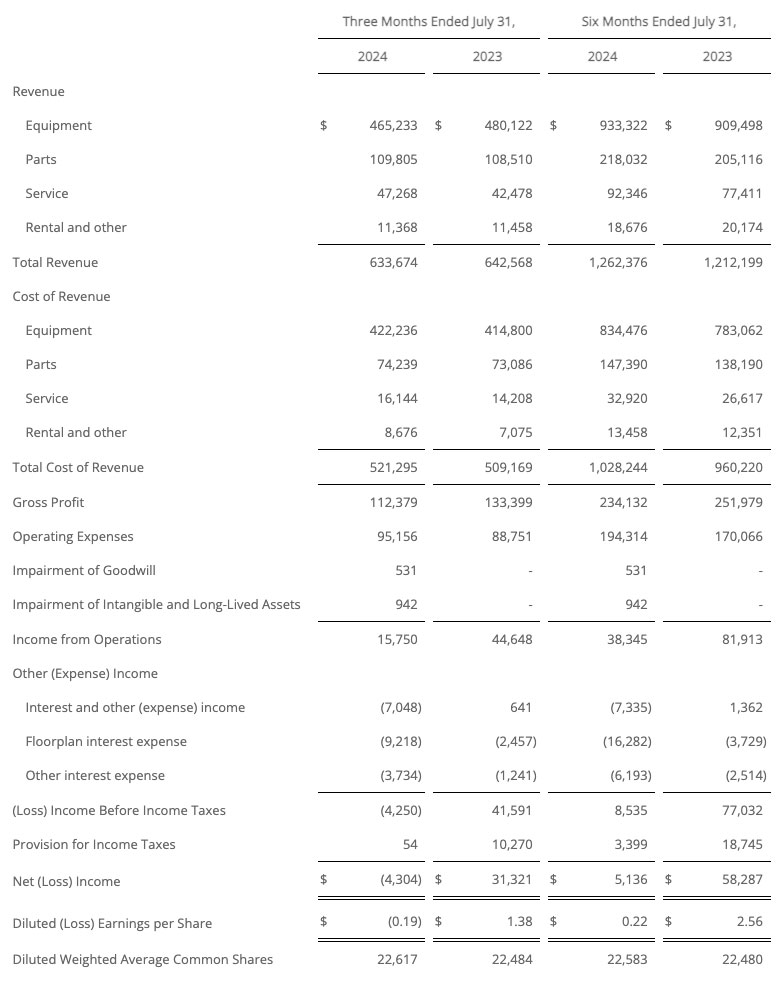

From a leading network of full-service agricultural and construction equipment sales across the globe, for the second quarter of fiscal 2025 Titan Machinery Inc has announced sales revenue of US$633.7 million at 31 July 2024, as compared to US$642.6 million the same time last year.

Titan Machinery President and Chief Executive Officer Bryan Knutson made some pertinent comments attributed to the global operation.

“Our second quarter results reflect the challenging market conditions that are impacting farmer sentiment and agriculture equipment sales.

“In response to these market dynamics, we have been executing on the strategies we outlined previously, actively managing our inventory levels with a focus on used equipment, implementing targeted cost control measures, and further emphasising our customer care initiatives to drive growth in our higher-margin parts and service businesses.

“The efficiencies and process improvements we’ve integrated into our business model since the last industry downturn are enhancing our ability to effectively manage through the current cycle and positioning us well to emerge stronger when market conditions improve.

“The improvements in our business, in conjunction with healthier industry dynamics, support our expectation that we will experience a more condensed contractionary period versus the previous cycle,” Bryan Knutson added.

Following the release of Titan Machinery results, analysts were quick to point out that the most likely scenario for all farm equipment dealers over the next 12 months will be acted out in most world regions as erosion of farm equipment demand.

This will be compounded at a dealer level with the need to de-stock and avoid expensive showroom floor plans on equipment that will most probably need to be discounted heavily before it leaves the yard.

The move to dealers de-stocking is currently at odds with distributors who up until now have been very firm on maintaining retail price levels, a situation that obviously cannot continue as farmers coming off boom seasons now find they also face slimmer farmgate margins, much of it compounded from the highest product input and equipment prices they have endured over the past three seasons.

Titan Machinery President and Chief Executive Officer Bryan Knutson explains further, “We recently updated our full-year fiscal 2025 modelling assumptions in conjunction with the announcement of our preliminary fiscal second-quarter results.

“In response to the softening of retail demand amid a difficult backdrop of significantly lower net farm income, we have implemented a more aggressive strategy to catalyse sales and reduce our inventories.

This strategy requires compression of our near-term equipment margins, and we believe these deliberate actions will help shorten the impact of this contractionary cycle on our performance and accelerate our return to a more normalised margin profile as the industry cycle progresses,” Bryan Knutson concludes.

Titan Machinery results for Q2

For the second quarter of fiscal 2025, revenue from the worldwide Titan machinery operation was US$633.7 million compared to US$642.6 million in the second quarter of last year.

Equipment revenue was US$465.2 million for the second quarter of fiscal 2025, compared to US$480.1 million in the second quarter of last year. Parts revenue was US$109.8 million for the second quarter of fiscal 2025, compared to US$108.5 million in the second quarter of last year.

While revenue generated from service was US$47.3 million for the second quarter of fiscal 2025, compared to US$42.5 million in the second quarter of last year. Revenue from rental and other income was US$11.4 million for the second quarter of fiscal 2025, compared to US$11.5 million in the second quarter of last year.

Gross profit for the second quarter of fiscal 2025 was US$112.4 million, compared to US$133.4 million in the second quarter of last year. The Company’s gross profit margin was 17.7% in the second quarter of fiscal 2025, compared to 20.8% in the second quarter of last year.

The year-over-year decrease in gross profit margin was primarily due to lower equipment margins which are being driven by higher levels of inventory and softening demand.

Operating expenses were US$95.2 million for the second quarter of fiscal 2025, compared to US$88.8 million in the second quarter of last year. The year-over-year increase was led by additional operating expenses due to acquisitions that have taken place in the past year.

Operating expense as a percentage of revenue was 15.0% for the second quarter of fiscal 2025, compared to 13.8% of revenue in the second quarter of last year.

Floorplan interest expense and other interest expense aggregated to US$13.0 million in the second quarter of fiscal 2025, compared to US$3.7 million for the same period last year, with the increase primarily due to a higher level of interest-bearing inventory, including the usage of existing floorplan capacity to finance the O’Connors Group acquisition.

In the second quarter of fiscal 2025, net loss was US$4.3 million, or loss per diluted share of US$0.19, compared to net income of US$31.3 million, or earnings per diluted share of US$1.38, for the second quarter of last year.

As previously announced, the second quarter of fiscal 2025 results included a one-time, non-cash sale-leaseback financing expense of approximately US$8.3 million or US$0.36 per diluted share; excluding this impact, adjusted net income was US$4.0 million and adjusted earnings per diluted share was US$0.17.

The Company generated US$9.1 million in EBITDA in the second quarter of fiscal 2025, compared to US$50.4 million generated in the second quarter of last year. Excluding the impact from the aforementioned one-time, non-cash sale-leaseback financing expense, adjusted EBITDA was US$20.2 million in the second quarter of fiscal 2025.

Titan Machinery division results

From the agriculture division, revenue for the second quarter of fiscal 2025 was US$424.0 million, compared to US$469.1 million in the second quarter of last year.

The decrease was primarily due to a same-dealer sales decrease of 11.2%, partially offset by contributions from the acquisition of Scott Supply, Co. in January 2024. The revenue decrease resulted from a softening of demand for equipment purchases due to lower farmer sentiment which is being driven by the decline of net farm income and sustained high interest rates.

Pre-tax income for the second quarter of fiscal 2025 was US$0.6 million, compared to US$33.0 million in the second quarter of the prior year. Included in the results for the second quarter of fiscal 2025, was a US$6.1 million one-time, non-cash sale-leaseback expense.

Construction Segment – Revenue for the second quarter of fiscal 2025 was US$80.2 million, compared to US$82.9 million in the second quarter of last year. Pre-tax loss for the second quarter of fiscal 2025 was US$4.9 million, compared to pre-tax income of US$5.2 million in the second quarter of last year.

Included in the results for the second quarter of fiscal 2025, was a US$5.1 million one-time, non-cash sale-leaseback expense.

From the European division, revenue for the second quarter of fiscal 2025 was US$68.1 million, compared to US$90.6 million in the second quarter of last year; which includes a US$0.6 million decrease in revenue from foreign currency fluctuations.

Net of the effect of these foreign currency fluctuations, revenue decreased US$21.9 million, or 24.1%. The year-over-year decrease in revenue was driven by the softening of new equipment demand, which was impacted by a decrease in global commodity prices, sustained high interest rates, and drought conditions in Eastern Europe.

Pre-tax loss for the second quarter of fiscal 2025 from the European operation was US$2.3 million, compared to pre-tax income of US$5.6 million in the second quarter of the prior year.

Compared to the European results, the Australia division fared much better, revenue for the second quarter of fiscal 2025 was US$61.3 million and pre-tax income for the second quarter of fiscal 2025 was US$1.4 million.

Titan Machinery 2Q US$633.7 million revenues at a glance