While fruit growers are the leading lights for increased production and export growth their vegetable growing cousins are finding it much tougher going

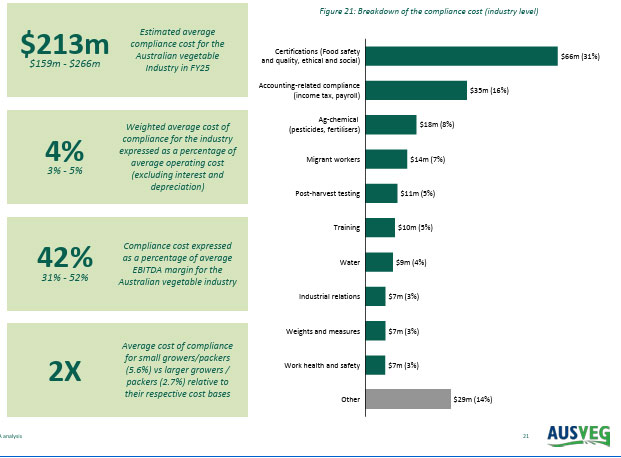

Research released by AUSVEG has, for the first time, quantified the significant cost and scope of the $213 million annual compliance, regulatory, and red tape burden that hampers vegetable growers.

The overwhelming compliance burden is hampering the productivity and profitability of vegetable growers to the point where two out of five growers don’t see long-term viability and are threatening to leave the vegetable industry.

The launch of the Horticulture compliance and regulation: reducing the burden by 2030report, comes as the 2025 AUSVEG Industry Sentiment Report – also released today – reveals an alarming and continuing decline in grower confidence that needs to be urgently addressed to keep up current levels of vegetable growing.

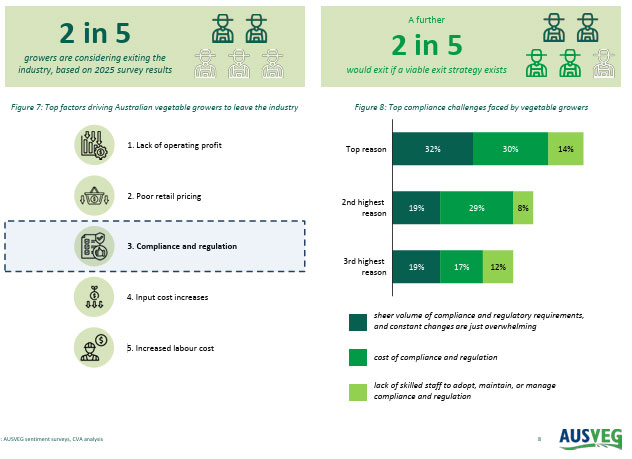

The results of the most recent AUSVEG Industry Sentiment Survey from July reveal that two in five vegetable growers (40%) are actively considering leaving the industry within the next year due to challenging business conditions, and that a further two in five would follow suit if they had a viable exit strategy. The proportion of growers actively considering exiting has jumped from an average of one in three (33%) since January 2025.

The latest Industry Sentiment Report reveals a continuation of the severe operating challenges consistently identified in AUSVEG’s six-monthly surveys of vegetable growers since 2023.

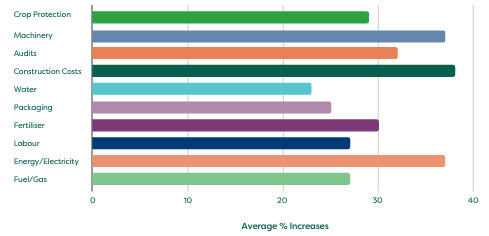

Challenges relate to a lack of operating profit for capital improvement, expansion and innovation; compliance burden; input cost increases; poor retail pricing; and increased labour costs have again been identified as the key issues leading growers to contemplate their future.

These challenges are contributing to declining profitability across the industry, with 62% of surveyed growers in July indicating they were financially worse off compared to 12 months ago, and 53% expecting to be worse off in a further year.

With the growing burden and cost of compliance regularly identified among the top productivity and profitability drains for Australian vegetable growers, AUSVEG commissioned Corporate Value Associates (CVA) Australia to produce the Horticulture compliance and regulation report.

The report includes a thorough examination of the current compliance and regulatory landscape in the vegetable industry, the impact on Australian vegetable growers, and recommendations to address these increasingly urgent issues.

Through the forensic examination of the operations of large and small vegetable growing businesses across the country, the report has identified that the cost of compliance across the vegetable industry is estimated at $213 million, or 4 per cent of a vegetable growing businesses’ average operating costs.

This equates to 42% of average vegetable industry earnings before interest, taxes, depreciation and amortization (EBITDA) of approximately 9%, illustrating the significant burden of compliance on vegetable growing businesses’ productivity and profitability.

A summary of key findings includes:

- The cost of compliance for vegetable growers has ballooned to an estimated $213 million per annum across the industry.

- Compliance costs account for 4 per cent of total average vegetable growing business costs, against average earnings before interest, tax, depreciation and amortization (EBITDA) of approximately 9 per cent (42% of average vegetable industry EBITDA).

- A 25% reduction in compliance costs would equate to savings of approximately $53 million per annum across the industry, representing a meaningful opportunity to improve profitability and productivity for vegetable growers across the country.

- Compliance and certification requirements for Australian vegetable growing and on-farm packing have increased significantly in number, scope, and complexity over the past 30 years, with compliance now covering around 50 separate areas of business operations.

- Almost nine in 10 growers reported negative impacts of compliance audits on stress levels and mental wellbeing.

- More than 4 in 5 Growers reported opportunities for improvement across key compliance areas.

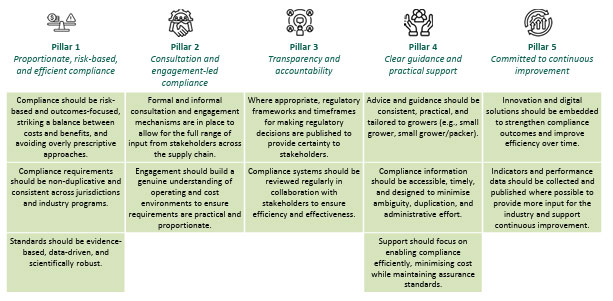

The report has also identified 34 actionable recommendations aimed at reducing duplication, improving efficiency of certification and audit processes, moving towards more results-focussed compliance, and a streamlining of government processes and support services.

AUSVEG is now working to urgently establish an industry taskforce to implement these recommendations as a crucial step to addressing the crisis in sentiment among the growers as Australia depends on 98% of the fresh vegetables consumed in this country.

AUSVEG CEO Michael Coote explains

“As sentiment in the vegetable industry has plummeted and remained at record lows, Australian vegetable growers have increasingly called out that overwhelming compliance burden is taking an unsustainable toll on their productivity, profitability and future viability, as well as their mental wellbeing. For the first time now, we have a true measure of those pressures.

“Compliance isn’t just about government requirements, but also the raft of audit, certification and other obligations imposed by service providers, supply chain partners, retailers, regulatory bodies and industry codes of conduct. These have continued expanding in scope, volume, and complexity, leading to duplication and snowballing time and cost pressures.

“Vegetable growers accept that certain compliance is necessary, particularly around food safety and the wellbeing of consumers, employees and themselves, but with the burden of compliance now equating to an estimated 42% of vegetable growers’ EBITDA, it is clear that even moderate compliance efficiencies will have material productivity and profitability benefits for vegetable growers, who operate in a typically low margin, high volume industry.

“Lifting industry productivity has been a keen focus of the Government since the federal election. Our latest Industry Sentiment Report shows vegetable growers currently rate their productivity as ‘average’ at best, and 72% say reducing compliance burden would provide them with a key boost, so moving now to implement the report’s recommendations is just common sense.

“Growers need to be spending less time filling in forms and doing repeated, time-consuming audits, and more time getting on with their real jobs, producing the world-class vegetables that Australians depend on.

“The warnings in our Industry Sentiment Report are clear – unless we see smarter, not harder, compliance regimes in the vegetable industry, and the key issues facing growers addressed, more and more will leave, supply will drop, and veggies will cost more for consumers.”

About AUSVEG Industry Sentiment Report

AUSVEG has conducted industry sentiment surveys every six months since 2023, to provide a current and cumulative snapshot of grower sentiment across the national industry. The surveys have attracted responses from large, medium and small-scale growers from all states and the Northern Territory. Respondents to the most recent survey conservatively represented $2.3 billion in annual turnover.

About AUSVEG

AUSVEG is the national peak industry body for Australia’s over 3,600 vegetable, potato and onion producers, who account for 3.8 million tonnes of vegetable production worth $5.7 billion in farmgate value annually. This accounts for one-third of Australia’s $17 billion horticulture industry.