With expectations of at least the third best harvest of all time we take a closer look at what each region can expect to harvest

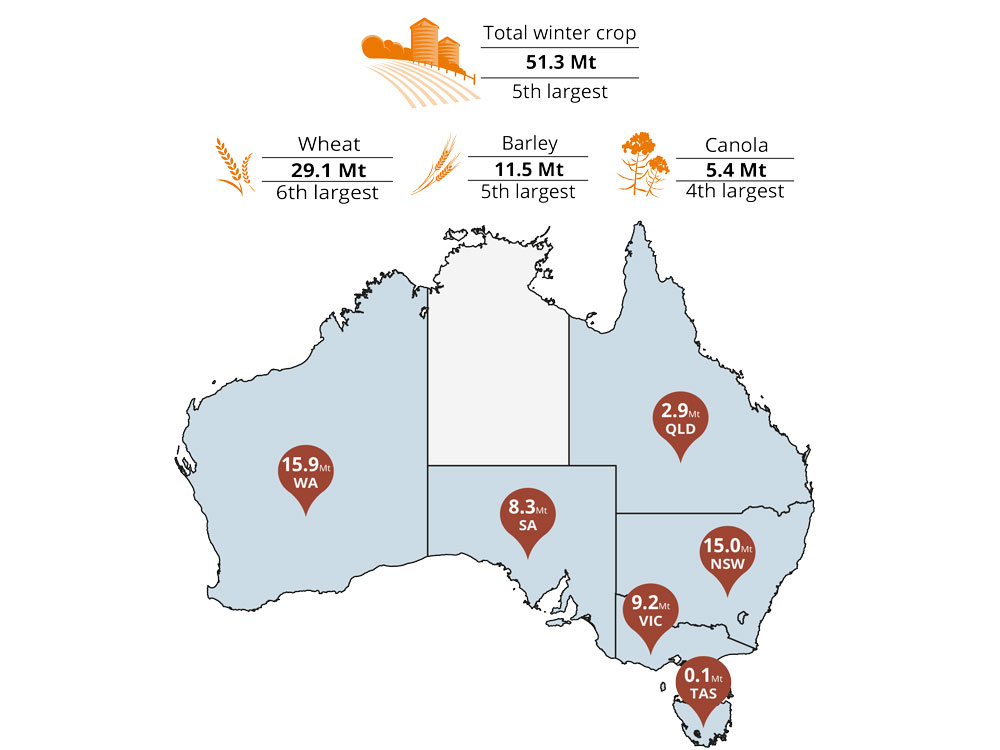

With national winter crop production expected to top 51.3 million tonnes, we take a closer look at what each state is predicted to add to the harvest.

Improved production outcomes for the 2023-24 winter season have been influenced by better than expected climatic conditions during late spring and summer benefiting crop production, as well as pasture growth across northern and eastern Australia.

As growers shift their focus to the 2024-25 production season, above-average summer and early autumn 2024 rainfall, particularly in the eastern cropping regions, has supported an increase in the areas planted to winter crops.

It is estimated 23.6 million/ha are under-crop, across all states.

And with between a 40 to 60% chance of above median rainfall across most cropping regions it will provide sufficient moisture for the third-best harvest on record.

The high rainfall is the result of a La Niña event that most often brings with it above-average rainfall to most growing regions and typically pushes wheat yield above average.

Here is a summary of what each state is predicted to harvest from the 2024-25 winter crop season.

Western Australia

Crop production in Western Australia is forecast to rise by 7% over last year to 15.9 million tonnes from the 2024-25 winter harvest.

This is a very conservative forecast as it’s 8% below the 10-year average to 2023-24 of 17.2 million tonnes.

This increase in annual production is largely attributed to higher expected yields to more than offsetting a fall in the area planted.

The area of 8.5 million/ha planted to winter crops in Western Australia in 2024-25 is what has stifled a more outstanding forecast.

But with plantings 2% above the 10-year average to 2023-24, the early forecast could be improved upon in real-time.

The forecast largely reflects a reduction in area sown in dry areas. Low levels of soil moisture discouraged planting in some regions, especially for high-risk crops such as canola.

Following drier and hotter than average conditions during autumn, soil moisture levels across most cropping regions in Western Australia have been below to very much below average during the winter crop planting window.

This means that a high proportion of the 2024-25 winter crop has been sown dry.

However, rainfall received since has benefitted crop germination. Sporadic rain from thunderstorms has allowed for some crop germination in northern cropping regions.

Adequate and timely rainfall will be required throughout the season to support the germination of dry sown crops, particularly in the Geraldton cropping zone where topsoil is dry and subsoil moisture is severely deficient.

Winter crop yields are forecast to rise by 9% in 2024-25 but remain below the 10-year average, reflecting the drier start to the season and below-average levels of soil moisture.

Above-average winter rainfall will likely provide sufficient moisture to support or improve current crop yield expectations.

Leading the plantings once again was wheat with a safe 4.70 million/ha planted, just 1% up on last year but with a harvest expected to produce 8.5 million tonnes, up 10% on last year.

Growers were bullish about the prospects of barley and planted 3% more than last year for an area of 1.65 million/ha. And at an expected yield level of 2.48 tonnes/ha the production total of 4.1 million tonnes was 11% up on last year.

While for canola, growers were 14% less enthusiastic than last year and only planted down an area of 1.45 million/ha, and on a yield of 1.45 tonnes/ha the production total of 2.25 million tonnes will be 10% down on last year.

Growers had a solid run with Lupins with a 5% increase in the area planted at 0.330 million/ha, and on a yield of 1.39 tonnes/ha the production total could increase to 0.460 million tonnes, up 11% on last year.

New South Wales

Winter crop productionin New South Wales is forecast to take a giant leap to increase by 36% to 15.0 million tonnes in 2024-25.

This is an overall stellar result for NSW growers as it is 28% above the 10-year average to 2023-24.

It was seen as an excellent start to the winter cropping season, and this gave most growers the ammunition to fully realise their strong planting potential.

The improvement in production prospects follows high levels of soil moisture at the time of planting, enabling growers to maximise cropping areas.

And in turn, the favourable winter rainfall outlook will also support the high yields expected.

Growers got away early with the area planted for winter crops in NSW with an increase of 10% to 6.1 million/ha in 2024-25.

This is a strong 10% rating above the 10-year average to 2023-24 and amounts to the largest year-on-year percentage increase for crop type in NSW this season.

The increase in wheat and barley plantings reflects above-average subsoil moisture across much of NSW at the time.

This increase in wheat and barley area includes many of those areas that did not get planted last season due to dry conditions.

However, drier conditions during autumn coupled with lower soil moisture levels in some southern cropping regions in New South Wales – where canola is predominantly grown – resulted in a quiet 1% year-on-year fall in area planted.

This reduction in canola plantings in some areas has boosted barley plantings, which are better suited to less favourable climatic conditions.

Winter crop yields are forecast to rise by 24% to 2.5 tonnes per hectare in 2024-25, a solid 23% above the 10-year average to 2023-24.

With average rainfall predicted for most cropping regions during the growing period, it will build upon the average to above-average soil moisture levels across much of NSW at the end of autumn.

As a result of these prevailing conditions, it is expected to support increased yield prospects.

The area planted for wheat in NSW was 3.6 million/ha, up a steady 9% over last year and with a yield prediction of 2.72 tonnes/ha the production total is expected to be a commanding 9.8 million tonnes, a 38% increase.

Barley was also high on the optimism list with NSW growers as an area of 0.870 million/ha was planted down, up 30% on last year. And with a predicted yield of 2.87 tonnes/ha the production total could reach 2.5 million tonnes. Up 9% from last year.

Meanwhile, canola managed to keep most of its followers with the area planted at 0.83 million/ha, with a yield of 1.93 tonnes/ha the faithful could be rewarded with a production total of 1.93 million tonnes. Up 19% from last year.

Victoria

It was getting to the stage where all Victorian growers were being followed into Lotto shops as their winning streak at harvest has been relentless.

However, that lucky run is over because winter crop production in Victoria is forecast to only reach 9.2 million tonnes in 2024-25, down by 13% on last year, but still forecast at 16% above the 10-year average to 2023-24.

Average rainfall during April at the start of the planting window supported what was already above-average soil moisture levels across the state following a wet summer.

However, for growers that waited, the drier than average conditions throughout May meant that a high proportion of the 2024-25 crop was sown dry.

Then it became a mixture of topsoil moisture continuing to dry out across the state, while subsoil moisture largely remained favourable, allowing growers to realise their full planting intentions.

The final result will rest with adequate and timely rainfall to support the germination of dry sown crops, particularly across the west and north of the state where a high proportion of winter crops are grown.

The area planted for winter crops in Victoria is expected to remain steady at 3.6 million/ha in 2024–25. This is 6% above the 10-year average to 2023-24.

For crop types, it is expected to increase by 2% for barley, but fall by 3% for wheat and 5% for canola as growers were drawn to incorporate pulses into their rotations.

This latent interest in the area planted to lentils is expected to swell to 400,000ha, 79% above the 10-year average to 2023-24.

It is expected that growers will favour lentils over other pulses given their current strong export prices that are expected to continue throughout 2024-25.

With below-average to average winter rainfall predicted for Victoria these conditions are expected to constrain yields and production across the state.

While there is an increased chance of below-average winter rainfall across southern growing regions, cropping regions are likely to receive sufficient rainfall to allow for germination and establishment of dry sown crops.

Winter crop yields are forecast to fall by 12% in 2024-25 but remain above the 10-year average to 2023-24.

Stored soil moisture in key growing regions is currently supporting these forecasts.

However, downside potential exists if the Mallee and Wimmera growing regions remain dry, with late crop emergence expected to result in yield penalties for these areas.

The seemingly never-ending income growth for Victorian growers appears to have reached a blip on the radar as the area planted for wheat is expected to be down 3% to 1.50 million/ha. And from a more medium yield of 2.90 tonnes/ha it pushed wheat production to a total of 4.34 million tonnes. Down 16% from last year.

Barley was more favoured for VIC growers, and they planted down an area of 0.85 million/ha, up 2% from last year. But with lighter yield expectations of 2.93 tonnes/ha the production total could slip to 2.93 million tonnes. Down 10% from last year.

Canola was also in a battle with Lentils with an expected area planted down 5% at 0.52 million/ha. With an expected yield of 2.03 tonnes/ha it’s all downhill for a production total of 1.05 million tonnes. Down 16% from last year.

Growers kept their faith with Lentils for an estimated 1% increase in the area planted at 0.400 million/ha, and on a yield of 1.91 tonnes/ha the production total could hold steady at 0.765 million tonnes, down just 2% on last year.

South Australia

Growers in South Australia kept looking to the heavens before planting and their paranoia was founded as at the finish there is an estimated fall of 6% to 8.3 million tonnes for the 2024-25 winter crop production.

This result reflects continued dry conditions across most cropping regions but is still 4% above the 10-year average to 2023-24.

A lack of rainfall during May and declining soil moisture levels across most cropping regions is why growers are faced with reduced production prospects in 2024–25.

The area planted for winter crops in South Australia is forecast to fall by 4% to 3.9 million/ha in 2024-25. This is 6% above the 10-year average to 2023-24.

The area planted for most crops is forecast to fall, reflecting well below-average autumn rainfall.

Canola is expected to see the largest decline in area planted, down 10% as persistent dryness impacted planting at the start of the winter cropping season.

Canola production in SA is in turn forecast to fall in 2024-25, also reflecting delayed germination that has resulted in yield penalties, particularly across the Eyre Peninsula.

And while the area planted to wheat, barley and canola has fallen, opportunistic growers have increased the area planted to lentils to take advantage of higher market prices.

There is a 40 to 60% chance of above-average winter rainfall for most cropping regions in South Australia.

However, drier conditions are expected in the far south of the Yorke and Eyre Peninsulas, with a 60 to 80% chance of below-average rainfall.

These conditions are expected to negatively impact yields and production in these traditionally higher yielding cropping regions.

Winter crop yields are forecast to fall by 2% to 2.1 tonnes per hectare in 2024-25 but remain around the 10-year average to 2023-24.

Despite below-average soil moisture levels, an average rainfall outlook for winter will likely provide sufficient moisture to facilitate the germination and establishment of dry sown crops and the completion of intended planting programs.

Growers in SA were nervous at the early stages of planting but gained some momentum and as a result, the wheat area is expected to come in just below last year at 2.1 million/ha. The expected yield is around the same as last year at a 2.19 tonnes/ha yield to realise a production level of 4.6 million tonnes. Down 4% from last year.

Barley was planted across an area of 0.80 million/ha, about the same as last year but a yield of 2.44 tonnes/ha is expected to reduce production to 1.95 million tonnes. Down 5% when compared with last year.

While the area planted for canola in SA dipped below last year at 0.26 million/ha, and a yield prediction of just 1.81 tonnes/ha will level the production total to 0.47 million tonnes. Down 18% on an already retracting crop last year.

Lentil seed suppliers and marketers have convinced growers to keep their plantings up, and as a result, Lentils have been flagged at an estimated 5% increase in the area planted at 0.460 million/ha.

On a reduced yield of 1.76 tonnes/ha when compared to last year, the production total could still increase to 0.810 million tonnes, up just 1% on last year.

Queensland

Nothing can go wrong for Queensland growers, for this season at least. Property prices have doubled, and right now everybody wants to move up north and farm in the sunshine.

Winter crop production in Queensland is forecast to increase by 68% to reach 2.9 million tonnes in 2024-25. This is 41% above the 10-year average to 2023-24.

The upswing in production has been preceded by ideal climatic conditions leading up to the planting window, enabling growers to maximise cropping areas this season.

Additionally, the average climate outlook for winter has provided favourable conditions for crop growth and development, subsequently maintaining strong yield potentials.

The area planted for winter crops in Queensland is forecast to be 1.4 million/ha in 2024-25, a rise of 27% year-on-year and 23% above the 10-year average to 2023-24.

Further good news for Queensland growers came with a tariff-free period for Australian grown chickpeas exported to India.

This has supported a rapid rise in chickpea prices, acting as a catalyst for a significant expansion in the chickpea area planted this season, increasing by 73% year-on-year to an expected 0.380 million/ha.

In good seasons, Queensland growers have paid their bills by relying on their chickpea crop.

The area expansion in chickpeas has come from ground left fallow during the 2023-24 winter season and further area becoming available following the harvest of summer crops.

Wheat and barley have also experienced a big upswing in the area planted, reflecting above-average subsoil moisture.

Winter crop yields are forecast to rise by 32% to around 2.0 tonnes per hectare in 2024-25, 20% above the 10-year average to 2023-24.

There is expected to be average rainfall for most cropping regions in Queensland throughout the growing season.

While the average to above-average soil moisture levels across much of Queensland at planting, combined with a neutral rainfall outlook for winter, are expected to maintain above-average yield prospects.

Following poor results from the 2023-24 winter cropping season, it did not dent enthusiasm for planting wheat in QLD with 0.840 million/ha in the ground, up a solid 17% over last year. And with a yield prediction of 2.14 tonnes/ha the production total is expected to be a respectable 1.8 million tonnes, a 67% increase.

Barley is also carrying some mighty high hopes of topping up bank accounts with an increase in plantings by 13% for an area of 0.17 million/ha. With a yield prediction of 2.65 tonnes/ha the production total could achieve 0.450 million tonnes. Up a welcome 50% on last year.

The solid QLD grower favourite, chickpeas shot up by an estimated 73% at planting to 0.38 million/ha, and with a yield of 1.47 tonnes/ha could produce a total of 0.560 million tonnes at harvest. Up 100% from last year.