Favourable rainfall outlook in cattle regions means restocker demand is likely to remain firm as herd rebuilding continues while there is good pasture availability

Australia’s beef production is expected to rise by 5% during the first half of 2023 but will remain well below average levels.

This comes on the back of favourable seasonal conditions providing good pasture availability and an advancing herd rebuild set to drive an increase in slaughter levels. Increased beef production will provide a greater surplus of beef to be exported.

A key risk to the recovery in beef production is labour availability which could limit the potential pace at which slaughter rates could rise.

Global beef production is forecast to remain relatively stable in 2023 as falls in US and European production are matched by gains in Australia and Brazil.

Brazilian beef production is forecast to increase by around one per cent due to strong global demand and the ongoing expansion of the industry.

The US is expected to record a decline in beef production during 2023 as the cattle herd has declined following high levels of culling in 2022.

The timing and size of the decline in US production will be pivotal factors impacting the performance of global beef markets.

Demand will be steady

Domestic demand for Australian beef is expected to remain robust in the first half of 2023. Inflationary pressures are likely to soften discretionary spending for consumers which may affect some higher-end beef products.

However, this may be partially alleviated as a rise in Australian supply could see beef prices ease.

Restocker demand is expected to be stable as the favourable rainfall outlook in key cattle regions will keep herd rebuilding progressing as there is good pasture available.

Global beef demand is expected to be mixed across Australia’s major export markets. US demand for imported beef is expected to rise during the first half of 2023 as high US culling rates decline.

China is also expected to see a marginal decline in import demand due to a rise in domestic supply. Additionally, China is also likely to continue to prefer purchasing from Brazil as bans remain in place on several Australian processers.

Demand from Japan and South Korea is likely to see a slight increase as consumption growth will continue to outpace domestic production in these markets. Opportunities for Australian beef should also expand into Japan and South Korea as US export volumes decline throughout the year.

Price point edgy

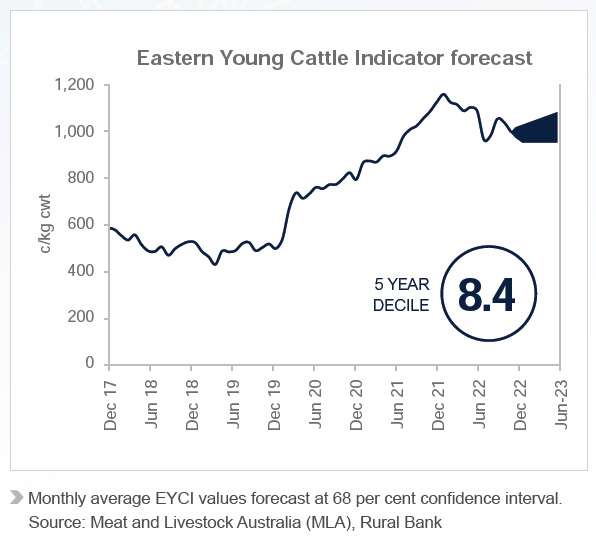

Australian cattle prices are expected to marginally decline throughout the first half of 2023.

Rising supply levels are likely to decrease the competitive pricing market for cattle as higher yardings occur from the advancing herd rebuild.

Global beef prices will gain support from declining US supply and the opportunities in export markets that it presents.